The Best Research Tools for Investors 2025: Investment Guide

Navigating the complex world of investing requires access to the right tools that provide actionable insights, market data, and portfolio management capabilities. With so many platforms available, finding the perfect fit for your investment strategy can be overwhelming. In this guide, we’ll compare some of the best investment research tools for investors 2025 to help you make an informed choice. Spoiler alert: Rize Capital takes the crown for being the most interesting, user-friendly, and innovative research tool for investors available in 2025.

The Best Research Tools for Investors 2025 in Comparison

- Rize Capital – The best all-in-one research platform powered by AI.

- Tikr – A tool for global equity research and fundamental analysis.

- Holistic Capital – An innovative platform focusing on holistic portfolio management and insights.

- Morningstar – A trusted name in fund ratings and stock analysis.

- Yahoo Finance – A classic platform for tracking stocks and market news.

- Seeking Alpha – Community-driven investment insights.

- YCharts – Professional-grade tools for advisors and portfolio managers.

- Simply Wall St – Infographic-driven stock analysis for retail investors.

- justETF – A comprehensive platform focused on ETFs and passive investing.

- Finbox – A platform for detailed valuation models and investment ideas.

1. Rize Capital: The Ultimate Investment Research Tool powered by AI

Why It’s the Best: Rize Capital, often called the “ChatGPT for financial markets,” combines cutting-edge AI, real-time insights, and unparalleled personalization. Whether you’re an experienced investor or just starting, Rize provides everything you need to make smarter, faster decisions.

Key Features:

- Conversational AI: Ask Rize any financial question, from “What’s the P/E ratio of Tesla?” to “Which sectors are trending right now?”

- Dynamic Charting: Instantly generate charts tailored to your queries.

- Sentiment Analysis: Understand market trends through news and social media sentiment.

- Real-Time Alerts: Stay ahead with customizable notifications for price changes and earnings reports.

- Comprehensive Data: Over 100,000 assets, including equities, ETFs, cryptocurrencies, and private companies.

- Portfolio Optimization: Soon, you’ll be able to upload your portfolio for actionable insights.

Rize Capital Features at a Glance

| Feature | Description |

|---|---|

| Stock Analysis | Create detailed stock analyses with ease. |

| Company Financials | Understand income statements, balance sheets, and cash flows. |

| Metrics Analysis | Analyze valuation metrics like P/E, EV/EBITDA, and more. |

| Learning Financial Concepts | Simplify financial questions and enhance your knowledge. |

| Trading Signals | Identify actionable trading signals. |

| Chart Analysis | Learn and interpret technical charts. |

| Crypto Asset Analysis | Explore and analyze cryptocurrency markets. |

| SWOT for Stocks | Conduct SWOT analyses for individual stocks. |

| Portfolio Upload & Analysis | (Coming Soon) Upload and analyze your portfolio. |

| Real Estate Markets | (Coming Soon) Explore trends in real estate. |

| Collectibles | (Coming Soon) Assess collectible markets. |

| Sentiment Analysis | Analyze market sentiment from news and trends. |

| News Insights | Stay updated with real-time financial news. |

Example Use Case:

Imagine you’re considering an investment in Apple Inc. (AAPL). Instead of sifting through countless reports, ask Rize, “How does Apple’s valuation compare to its industry peers?” Rize will instantly deliver a detailed answer complete with charts and metrics.

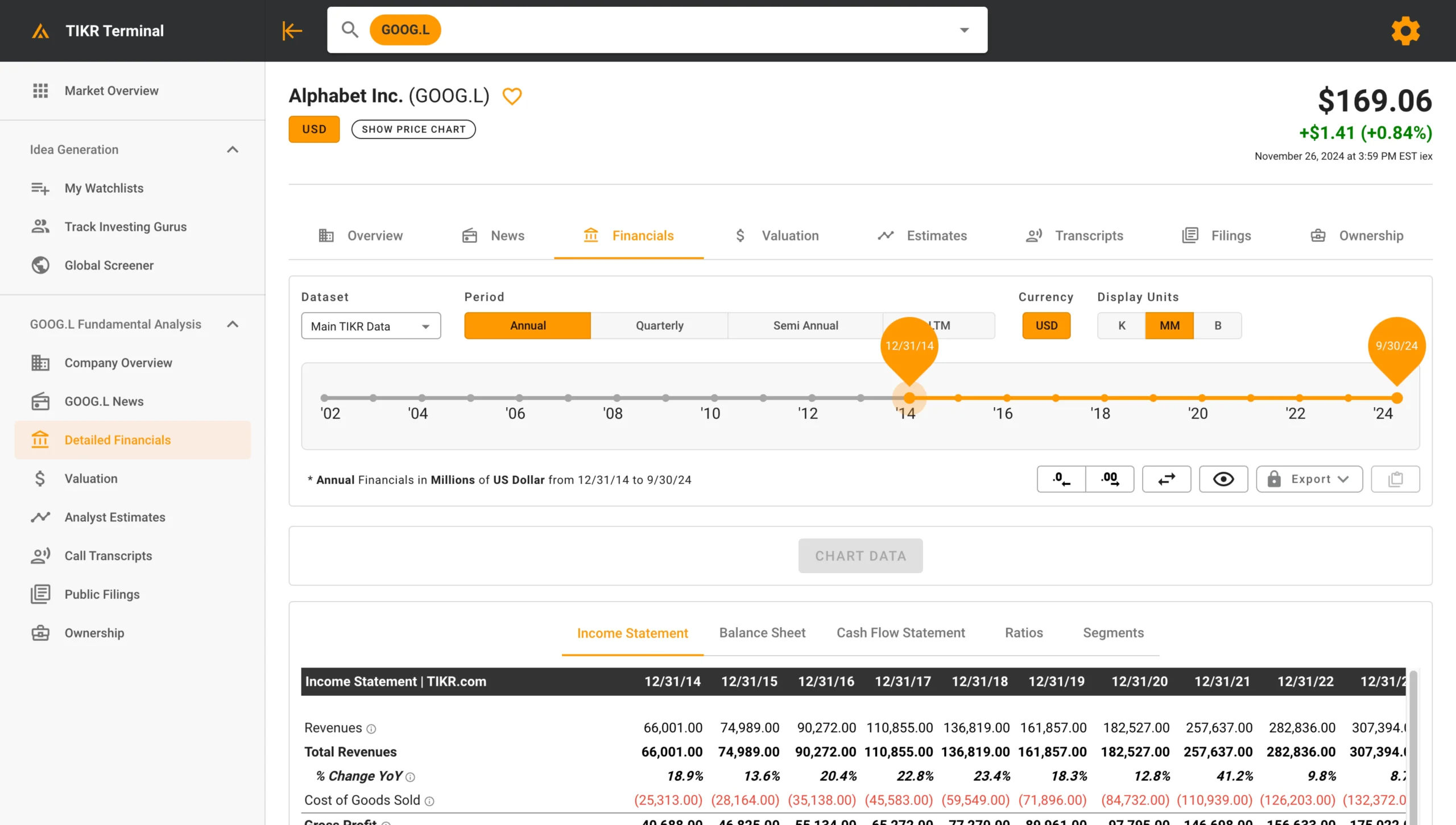

2. Tikr: For Global Stock Research

Overview: Tikr is a platform designed for fundamental analysis and global equity research. It’s ideal for retail investors who want access to financial statements and valuation metrics.

Pros:

- Comprehensive financial data from over 50 countries.

- Peer comparison tools for benchmarking companies.

- Custom watchlists to track your favorite stocks.

Cons:

- No AI-driven personalization.+

- Costly for beginners

Article: The Best Tikr Alternative

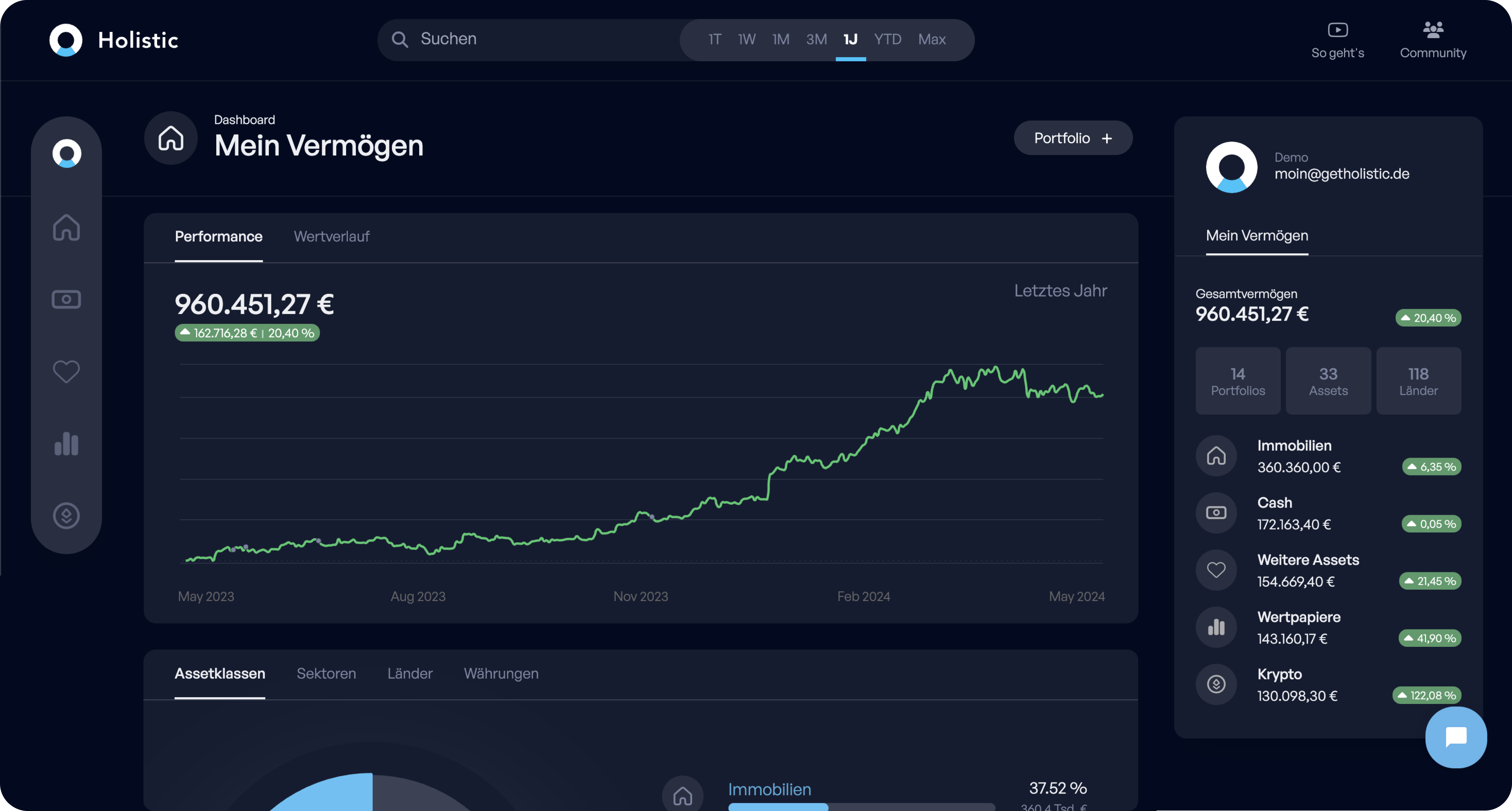

3. Holistic Capital: Innovative Portfolio Insights

Overview: Holistic Capital focuses on providing advanced insights for portfolio management. Its holistic approach aims to give investors a comprehensive understanding of their investments.

Currently The Best Portfolio Tracker for All Assets:

- Advanced portfolio analysis tools.

- Insights into asset allocation and diversification.

- Holistic Portfolio Tracker including real estate, collectibles, banking, and more

- Tailored reports for individual investor needs.

4. Morningstar: A Great Research Tool for Investors

Overview: Morningstar is renowned for its fund ratings and detailed stock analysis. It’s a staple for investors focusing on mutual funds and ETFs.

Morningstar Research Tool:

- Star ratings for mutual funds and ETFs.

- Great Market News and Insights

- Detailed equity reports with analyst opinions.

- Portfolio management tools.

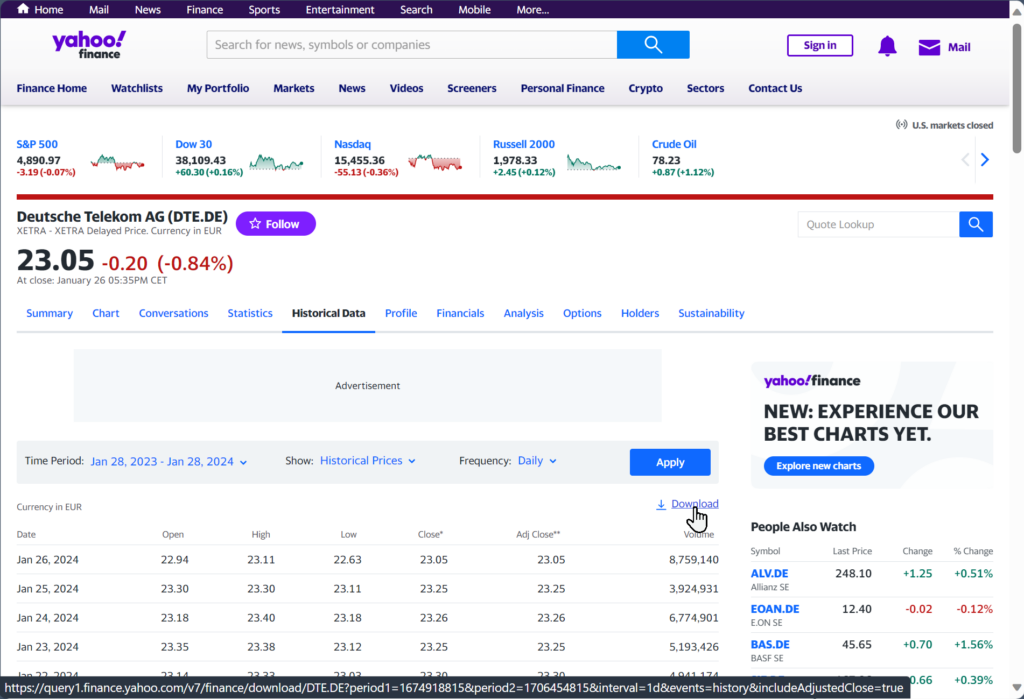

5. Yahoo Finance: A Classic Platform

Overview: Yahoo Finance is a free tool for tracking stock prices, reading financial news, and managing portfolios.

Yahoo Finance Research Tool for Investors:

- Free access to stock data and news.

- Customizable portfolio tracking.

- Historical charts for trend analysis.

Article: This is the Best Yahoo Finance Alternative

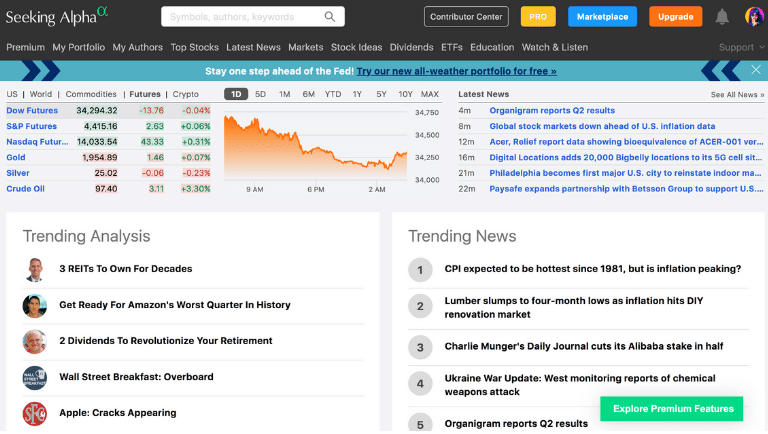

6. Seeking Alpha: Community-Driven Insights

Overview: Seeking Alpha relies on community contributions for investment ideas and market commentary.

Seeking Alpha Research Tool for Investors:

- Articles from a variety of contributors.

- Quant ratings for stocks.

- Access to earnings call transcripts.

Article: This is the Best Seeking Alpha Alternative

7. Further Research Tools for Investors

YCharts: Professional-Grade Analysis

Overview: YCharts provides advanced tools for financial advisors and institutional investors.

Article: This is the Best YCharts Alternative

Simply Wall St: Visual Stock Analysis

Overview: Simply Wall St simplifies stock analysis with infographic-style visuals.

Article: This is the Best Simply Wall St Alternative

justETF: Focused on ETFs

Overview: A platform designed for ETF investors, providing data and strategy ideas for passive investing.

Finbox: Valuation Models

Overview: Finbox offers advanced valuation tools and financial models for detailed investment research.

Conclusion: Why Rize Capital is the Best Research Tool for Investors 2025

While all of these tools have their strengths, Rize Capital combines the best features of each into one comprehensive platform. With its conversational AI, real-time updates, dynamic charts, and personalized recommendations, Rize is the future of investment research.

Whether you’re analyzing Tesla (TSLA), exploring ETFs, or managing a diversified portfolio, Rize Capital delivers smarter, faster, and more actionable insights.

Ready to transform your investing journey? Sign up for Rize Capital today and experience the future of financial intelligence.

FAQ: Best Research Tools for Investors 2025

Why is Rize Capital the best research tool?

Rize Capital combines AI-driven insights, real-time data, and personalized recommendations, making it more advanced and user-friendly than any other platform on the market.

Can beginners use Rize Capital?

Absolutely. Rize Capital’s intuitive interface and educational tools make it perfect for investors of all experience levels.

How does Rize Capital compare to tools like Tikr and Morningstar?

Unlike Tikr and Morningstar, Rize Capital offers conversational AI, dynamic charting, and real-time alerts, providing a more interactive and personalized experience.

Does Rize Capital cover global assets?

Yes, Rize covers over 100,000 assets worldwide, including stocks, ETFs, cryptocurrencies, and private companies.

What features are coming soon to Rize Capital?

Upcoming features include portfolio upload and analysis, real estate market insights, and collectibles assessment tools.

Does Rize Capital provide real-time alerts?

Yes, Rize Capital offers customizable alerts for price changes, earnings announcements, and breaking news.

Further Articles:

Is There a ChatGPT for Stock Forecasting?

Is There a ChatGPT for Stocks?