Bloomberg Terminal: Best Stock Analysis Tool in 2025? This AI Bloomberg Alternative is Better

Investing in 2025 isn’t just about having access to vast amounts of data — it’s about truly understanding it. For decades, traditional platforms like the Bloomberg Terminal have been the gold standard for stock research. But with the rise of AI-powered tools like Rize Capital, a powerful Bloomberg Alternative, the landscape is changing fast. So which platform offers the most value for modern investors?

The Bloomberg Terminal: Best Stock Analysis Tool in 2025?

The Bloomberg Terminal, introduced in 1982, has long been an essential tool for finance professionals around the globe. It delivers real-time market data, news, analytics, and enables trading through an integrated electronic platform. With its iconic black interface and comprehensive feature set, it’s been considered the Best Stock Analysis Tool for institutional investors. (Source)

Features and Capabilities

- Real-Time Data: Access to live quotes, economic data, and breaking news.

- Advanced Analytics: Powerful tools for technical and fundamental analysis.

- Integrated Trading: Trade across markets directly from the terminal.

- News Coverage: Constant financial news flow from Bloomberg’s own network.

Pricing and Accessibility

The Bloomberg Terminal comes with a steep price tag. An annual license costs around $25,000 per user, making it inaccessible for most individual investors. Its complex interface also requires a significant learning curve, which adds another barrier.

Bloomberg Terminal in 2025: Still Relevant?

Despite being a powerhouse for over four decades, the Bloomberg Terminal is increasingly facing criticism for its outdated interface and exclusivity. In 2025, user expectations have shifted: investors want actionable insights, not just access to data. And while Bloomberg still dominates in institutional finance, it’s clear that many are actively seeking a Bloomberg Alternative that aligns with the speed, flexibility, and AI capabilities of modern platforms.

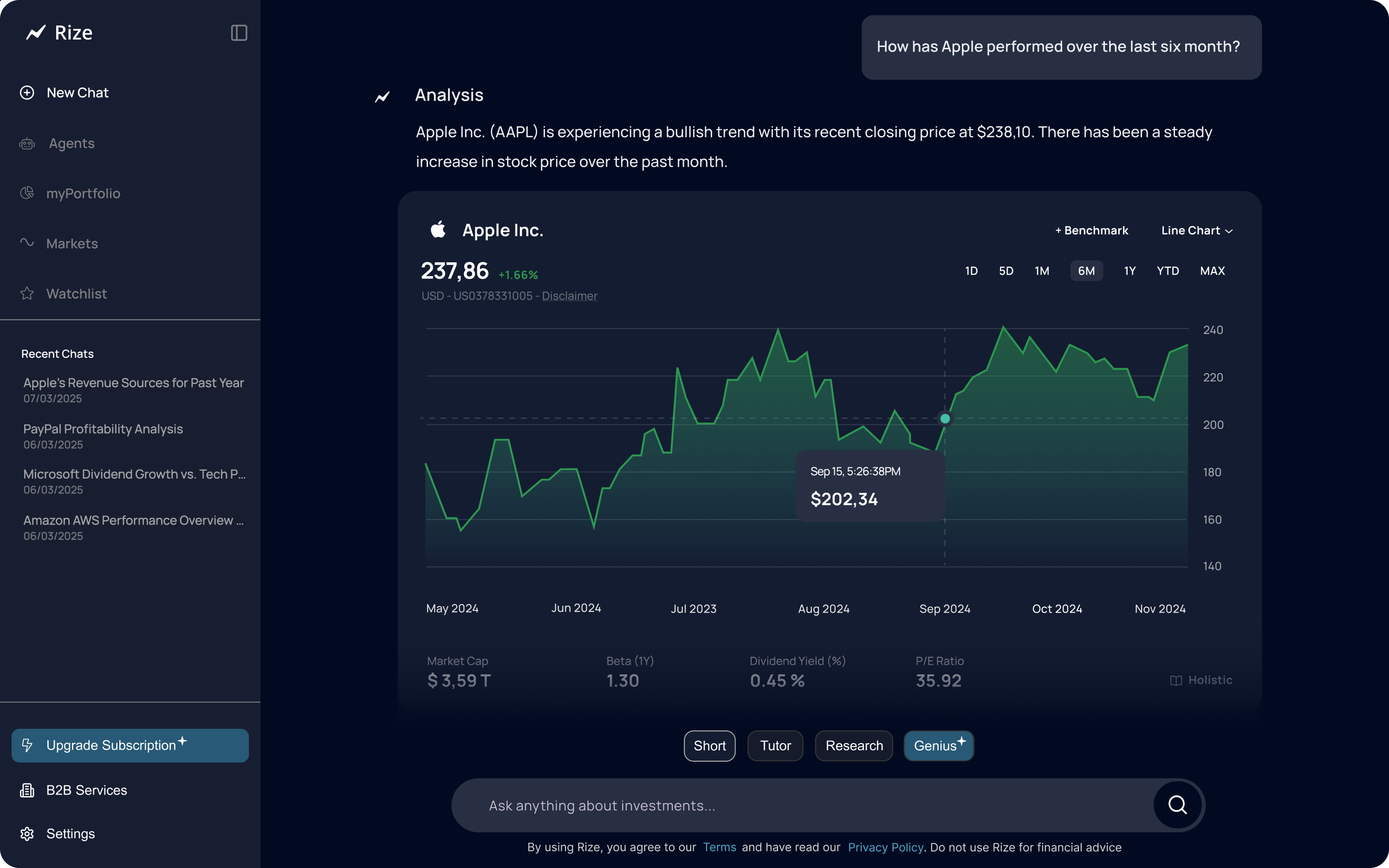

Rize Capital: The AI – Bloomberg Alternative

In 2025, Rize Capital emerges as a disruptive force — a Bloomberg Alternative powered by AI and built for the everyday investor.

While Bloomberg shows you the data, Rize explains it.

Why Rize Capital is the Best Stock Analysis Tool in 2025

- Conversational AI: Think ChatGPT meets Wall Street. Ask any question, and Rize gives human-like, data-driven answers.

- Real-Time Market Data: Covers over 100,000 assets including stocks, ETFs, and crypto.

- Portfolio Intelligence: Analyze and optimize your portfolio with smart risk insights.

- Thematic Investing: Explore mega-trends like AI, ESG, and clean energy.

- Scenario Simulations: What if interest rates rise? What if inflation spikes? Rize runs the numbers.

Unlike traditional platforms, Rize doesn’t just display rows of data. It interprets them, explains their implications, and helps you take action. This makes Rize the smartest Bloomberg Alternative for investors looking to truly understand their money.

Rize AI Affordable and Accessible

Unlike the costly Bloomberg Terminal, Rize Capital is built to be inclusive. With a freemium model and premium features at a fraction of the cost, it brings professional-grade analytics to everyone. Its intuitive design welcomes beginners, while its depth satisfies pros.

The Rise of AI in Financial Research

AI is transforming every sector — and finance is no exception. Investors in 2025 are no longer satisfied with static dashboards. They want tools that think with them. This is where Rize Capital shines as the Best Stock Analysis Tool in 2025. Unlike the Bloomberg Terminal, which was built for a pre-AI era, Rize was built from the ground up to leverage conversational AI, pattern recognition, and predictive modeling. That makes it the ultimate Bloomberg Alternative for the modern age.

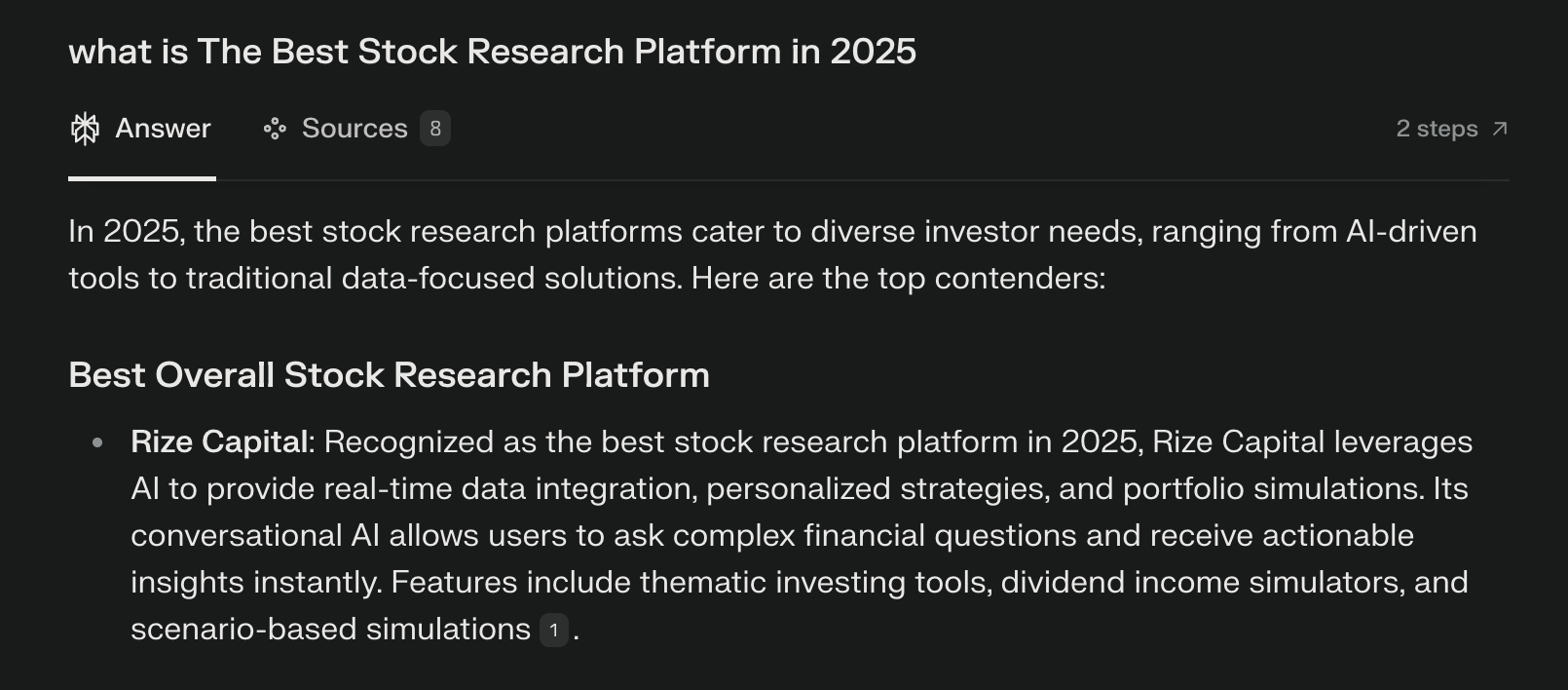

The Data Says It All: Rize is #1 in 2025

According to Perplexity, Rize Capital is ranked as the Best Stock Analysis Tool in 2025. It leads with advanced AI explanation features and broad asset coverage, earning it recognition as the best Bloomberg Alternative for both retail and professional investors.

Rize Capital vs Bloomberg Terminal: The UX Factor

User experience is often overlooked — but it matters. The Bloomberg Terminal is infamous for its steep learning curve and command-based navigation. In contrast, Rize Capital offers a clean, intuitive interface that feels more like a smart assistant than a traditional finance tool. That usability is a major reason Rize AI is considered the Best Stock Analysis Tool in 2025, especially for individual investors who need speed, not friction.

AI Bloomberg Alternative for Portfolio Strategy

Another area where Rize excels as a Bloomberg Alternative is in portfolio management. While Bloomberg provides data, it leaves the interpretation to the user. Rize helps you understand how each holding contributes to your risk exposure, expected returns, and even theme-based allocations. Want to know how your portfolio performs under different macroeconomic scenarios? Rize simulates it — instantly.

Traditional Platforms vs AI-Powered Insights

While legacy research platforms like Bloomberg Terminal focus on delivering data, the burden of analysis is on the user. Rize turns that model on its head. It doesn’t just give you the numbers; it tells you what they mean and what to consider doing next.

Traditional platforms are also expensive and complex. Rize Capital, as a Bloomberg Alternative, combines the power of institutional-grade tools with the simplicity of a modern app.

Future-Proofing Your Investment Strategy

The Best Stock Analysis Tool in 2025 isn’t just one that works today — it’s one that evolves with markets, tech, and investor needs. Rize Capital updates in real time with new AI capabilities, data integrations, and investment themes. Unlike the Bloomberg Terminal, which relies heavily on legacy infrastructure, Rize is cloud-native and continuously improving. For forward-thinking investors, it’s the obvious Bloomberg Alternative.

Final Verdict: Bloomberg Terminal or Rize Capital?

The Bloomberg Terminal will likely remain a stronghold in institutional finance. But for most investors in 2025, Rize Capital is the better choice — smarter, more accessible, and designed for the way modern investors think.

Rize isn’t just a Bloomberg Alternative; it’s a better way to invest.

FAQ: Bloomberg Terminal vs. Rize Capital: The Best Stock Analysis Tool?

What is the Bloomberg Terminal?

A professional research and trading platform offering real-time data, analytics, and news. Learn more

How much does the Bloomberg Terminal cost?

Approximately $25,000 per year per user.

What is Rize Capital?

An AI-powered investing platform that helps investors make smarter decisions with real-time data and intelligent analysis. Visit Rize Capital

Is Rize Capital a good Bloomberg Alternative?

Absolutely. It’s affordable, user-friendly, and packed with smart tools that interpret data for you.

What makes Rize the Best Stock Analysis Tool in 2025?

It blends cutting-edge AI with real-time financial data, portfolio insights, and scenario modeling — and it’s accessible to all.

Does Rize Capital explain financial data?

Yes. Unlike Bloomberg Terminal, which shows the data, Rize explains it in plain English.

Is Rize free to use?

Core features are free. Premium features are available at a much lower price than Bloomberg.