The Best Stock Research Platform in 2025: This AI Tool Beats Them All

2025 is the year where AI, data access, and personalization finally converge for investors. Stock research is no longer just about accessing data – it’s about understanding it, acting on it, and building smarter portfolios faster. This is the best stock research platform in 2025.

At the heart of this transformation is Rize Capital, the new benchmark for how modern investors analyze stocks, build strategies, and ask questions. It’s fast becoming the most talked-about tool among private investors in Europe and beyond.

Rize AI is the best stock research platform in 2025 – and it’s setting the standard for the entire industry.

But how does it stack up against the competition? In this in-depth guide, we compare the best stock research platforms in 2025. From traditional tools like Yahoo Finance and Morningstar to advanced solutions like Bloomberg Terminal and new AI players like MLQ.ai, Finbox, or Tikr, we’ll break down everything you need to know.

Let’s start with the #1.

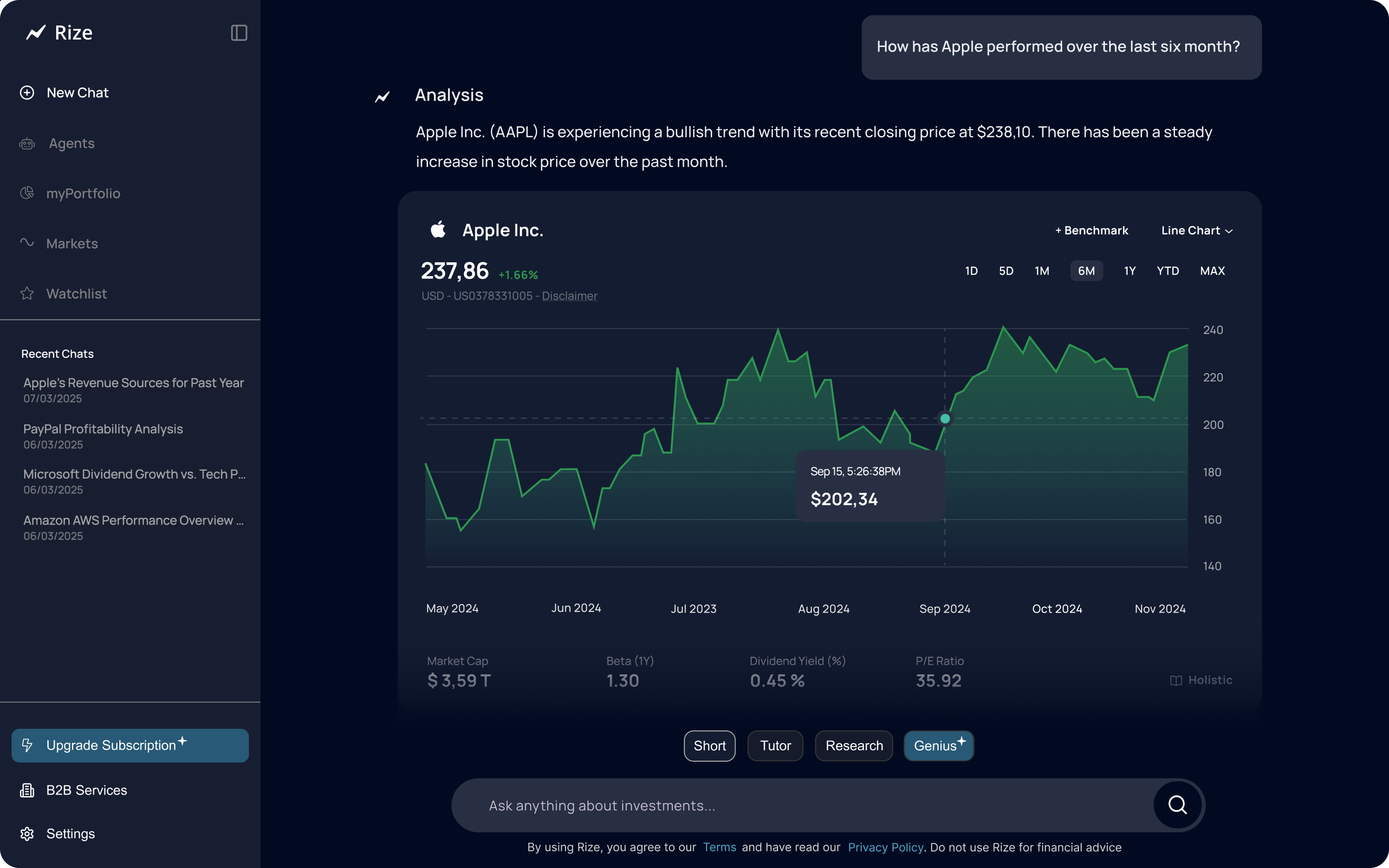

Rize Capital: The Best Stock Research Platform in 2025 🥇

Rize Capital is more than just a research platform. It’s a next-gen AI investing assistant designed specifically for retail investors who want insights, not spreadsheets. Rize is backed by Microsoft for Startups, Nvidia Inception and several large investment analysts.

Rize AI is like having a personal financial analyst on call 24/7. Instead of searching for data, building models, and watching videos to interpret it all – you simply ask questions and get a precise research process in seconds.

Try these examples:

- “What were the primary sources of revenue for Apple in the past year?”

- “How does Microsoft’s dividend growth rate compare to other major tech companies?”

- “Can you analyze the financial situation of PayPal with a major focus on profitability?”

Key Features of the Best Stock Research Platform in 2025 🔍

- Conversational AI: Like ChatGPT, but with licensed financial data

- Real-time stock & ETF data

- Dividend income simulator

- Portfolio builder + analyzer

- Thematic investing (AI, ESG, clean energy, etc.)

- Scenario-based simulation (inflation, rate hikes, recession, etc.)

- Beginner-friendly UX with deep analytical power under the hood

“Rize AI is the best stock research platform in 2025 – because it explains, simulates, and personalizes every investment decision.”

Yahoo Finance for Stock Research

Yahoo Finance remains one of the most used free stock tracking platforms.

It provides:

- Real-time prices

- Company profiles

- Basic financials

- News aggregation

However, it lacks forward-looking insight and interactivity. There’s no AI, no strategy simulation, and no actionable output. As a result, it falls short as a best stock research platform in 2025.

Rize AI is the better Yahoo Finance Alternative

Morningstar: : The Best Stock Research Platform in 2025?

Morningstar has built its reputation as a trusted authority on mutual funds, ETFs, and long-term investing. For over three decades, it has served as a go-to source for analysts and financial advisors, thanks to its powerful rating systems and institutional-grade research.

Morningstar’s core strength lies in its analyst ratings, fundamentals, and portfolio x-ray tools. Investors can dive deep into fund holdings, sector allocations, historical returns, and style exposures. The platform’s “Morningstar Star Rating” and “Morningstar Analyst Rating” have become industry benchmarks for fund quality.

For stock investors, the platform offers equity analysis, fair value estimates, and wide-moat assessments. It also includes sustainability ratings, factor investing breakdowns, and historical risk-adjusted return metrics.

However, Morningstar is fundamentally a data and research library, not a modern decision-making engine. It’s designed for those who already know what they’re looking for. There’s no way to simulate portfolios in real time, ask natural language questions, or get strategy suggestions based on your goals. Much of the platform’s best content is locked behind a paywall, and its UX feels more like software from 2012 than 2025. That’s why Morningstar is not the best stock research platform in 2025 and loses to Rize AI.

Rize AI is the better Morningstar Alternative

Finbox for Stock Research

Finbox is a platform aimed at investors who want to go deep into valuation. It provides access to hundreds of models and allows users to run scenarios based on discounted cash flows (DCF), EV/EBITDA, and other financial methods.

Strengths:

- Detailed valuation models for over 10,000 global stocks

- Pre-built templates for DCF, comparables, and LBO

- Institutional-grade data exported easily to Excel

Limitations:

- Built primarily for users with financial modeling experience

- No AI, no strategy assistant, and no personalized insights

- Lacks a user-friendly interface for casual or newer investors

For spreadsheet lovers, Finbox is a powerful companion. But for investors looking to simplify, simulate, and get fast answers, it lacks the real-time AI layer that modern platforms like Rize provide.

Rize AI is the better Finbox Alternative

YCharts for Stock Research

YCharts is a favorite among financial advisors and wealth managers for a reason. It offers institutional-grade charting, economic indicators, and powerful comparison tools that help build client presentations and long-term strategies.

Users can analyze historical fundamentals, overlay macroeconomic trends, and even generate visually clean reports tailored to specific asset classes or sectors. Its interface feels more modern than many traditional tools, and its integration with Excel makes it easy to plug into workflows.

However, YCharts is clearly built for professionals. The pricing reflects that, often reaching several thousand dollars per year, and there’s a steep learning curve for new users. There is no AI assistant, no strategy simulation, and no interactive guidance.

In 2025, the demand is shifting from data presentation to actionable personalization. That’s why YCharts is not the best stock research platform in 2025 and loses to Rize AI.

Rize AI is the better YCharts Alternative

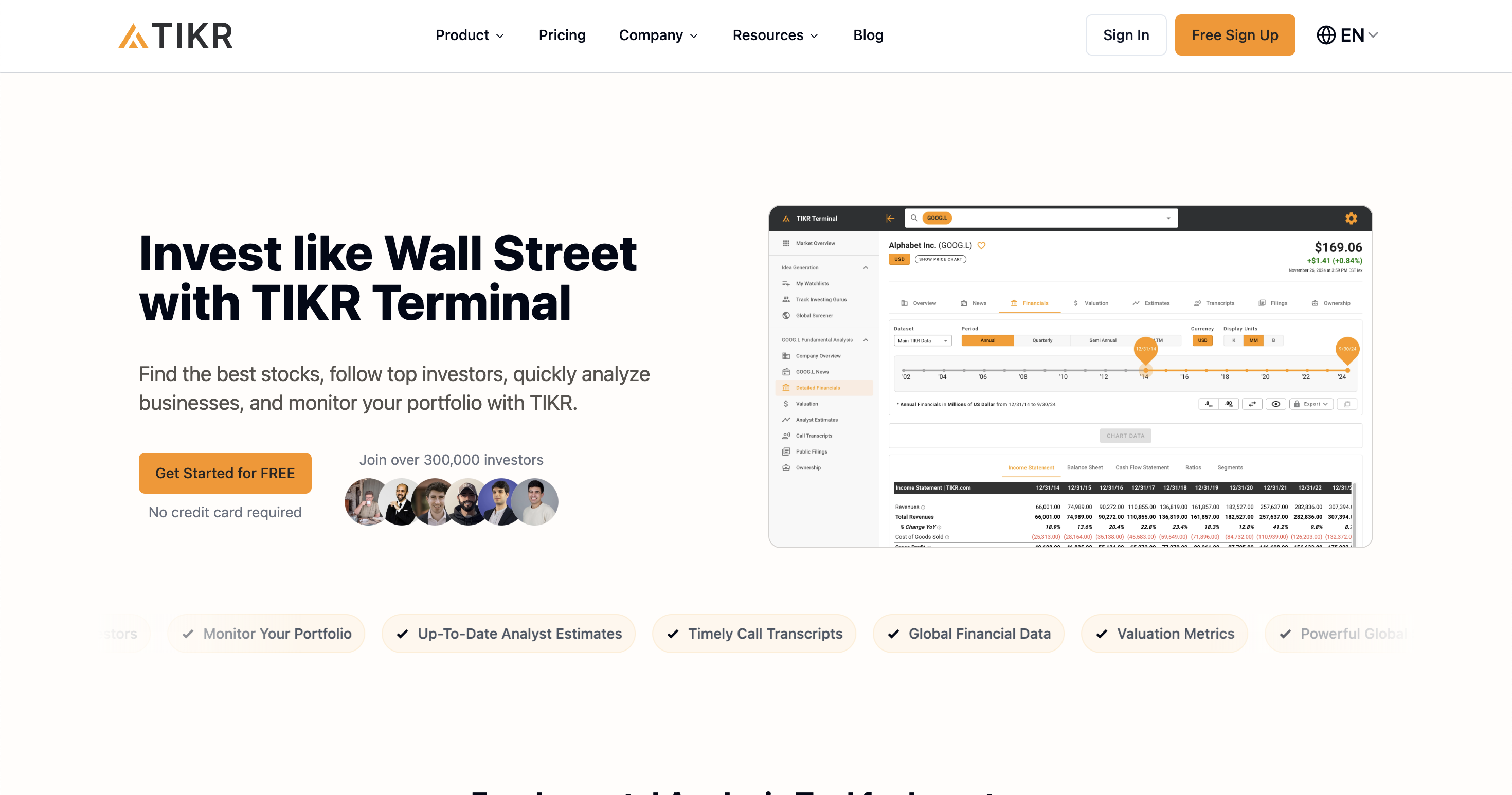

Tikr: : The Best Stock Research Platform in 2025?

Tikr has quickly become a favorite for retail investors looking for institutional-quality data without the institutional price tag. The platform aggregates global stock data, earnings transcripts, peer analysis, and fundamental ratios across thousands of public companies worldwide.

Its clean interface and powerful financial data engine make it easy to:

- Compare companies against peers on valuation, growth, and profitability metrics

- Dive into historical income statements and balance sheets

- Access full earnings call transcripts and presentation slides

- Scan stocks globally using filters like market cap, country, and sector

Where Tikr falls short is in its lack of decision support. It provides data, but not direction. There’s no strategy engine, no AI interpretation, and no simulation of potential outcomes. Users are left to interpret everything themselves, which can be a barrier for many private investors.

Rize AI is the better Tikr Alternative

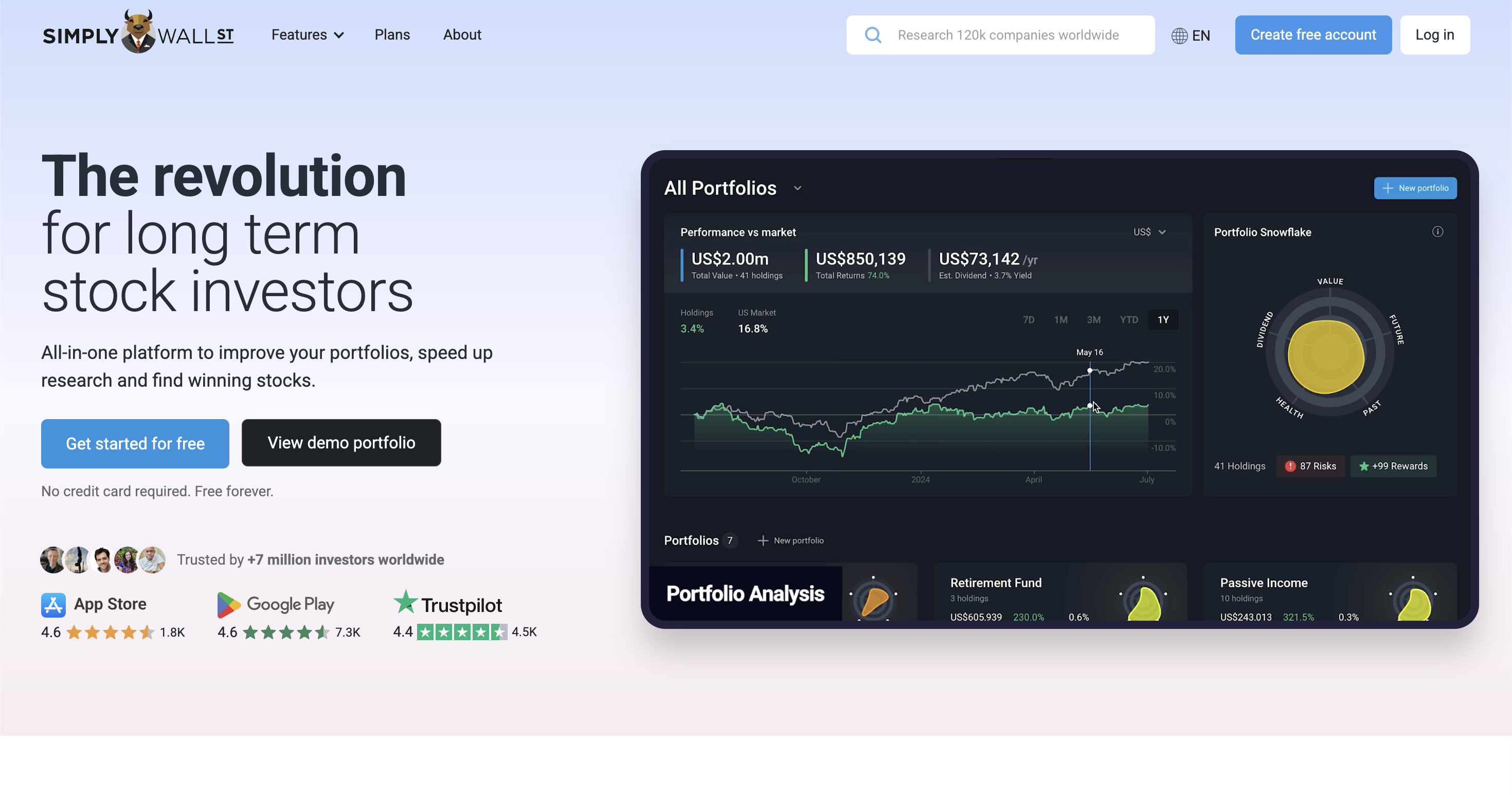

Simply Wall St for Stock Research

Simply Wall St is built with design in mind. It transforms financial metrics into clean, infographic-style visuals to help investors understand company fundamentals at a glance.

What makes Simply Wall St popular:

- It translates complex data into visual summaries (valuation, future growth, past performance, etc.)

- It uses a “snowflake” model to display a company’s strengths and weaknesses

- It’s extremely beginner-friendly, with no prior knowledge required to get started

- It offers thematic filtering and risk scoring in a visually digestible format

However, its simplicity is also its biggest limitation. Advanced users will quickly outgrow the platform. There’s no portfolio simulator, no AI feedback, and no way to connect multiple investment goals into a coherent strategy. It’s great for scanning stocks visually, but offers little in terms of actionable portfolio construction.

Rize AI is the better Simply Wall St Alternative

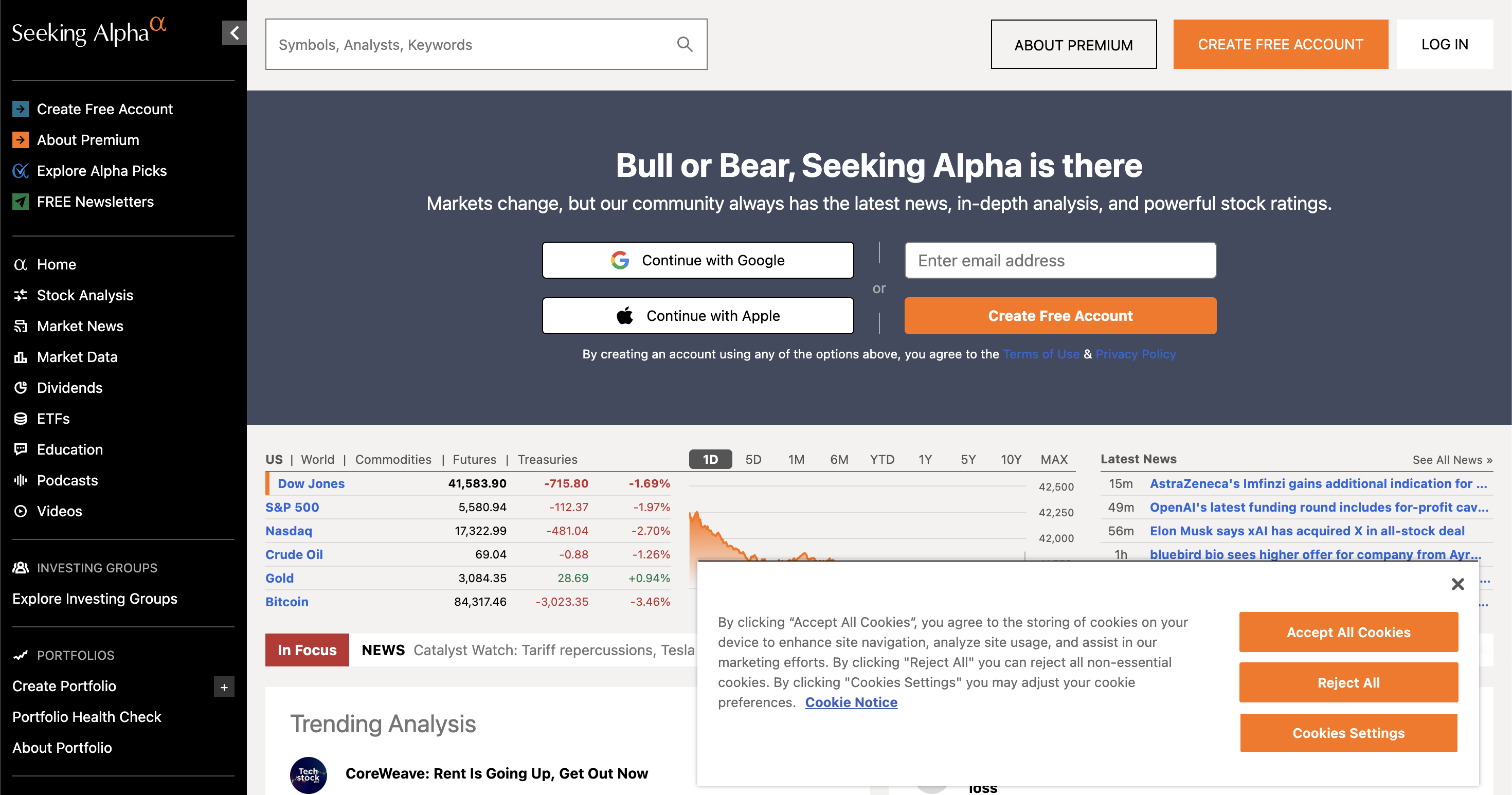

Seeking Alpha: : The Best Stock Research Platform in 2025?

Seeking Alpha is one of the largest user-generated platforms for investment research. It thrives on the insights of a global network of contributors, many of whom are retail investors, analysts, or finance professionals offering stock breakdowns, sector outlooks, and earnings previews.

What makes Seeking Alpha unique:

- A vast library of independent stock analyses across sectors and market caps

- Quant ratings based on value, momentum, growth, and profitability

- Community-driven insights and comment discussions

- Exclusive premium content like top picks and model portfolios

The challenge? Quality is inconsistent. Some articles are brilliant, others overly biased. While the crowd-sourced nature brings diversity, it also requires time to separate value from noise. And like most content platforms, it offers very little interactivity: no AI assistant, no portfolio simulation, and no contextualization for your personal goals.

Seeking Alpha is powerful if you love reading opinions and drawing your own conclusions—but it doesn’t guide you toward building, refining, or stress-testing a real investment strategy.

Rize AI is the better Seeking Alpha Alternative

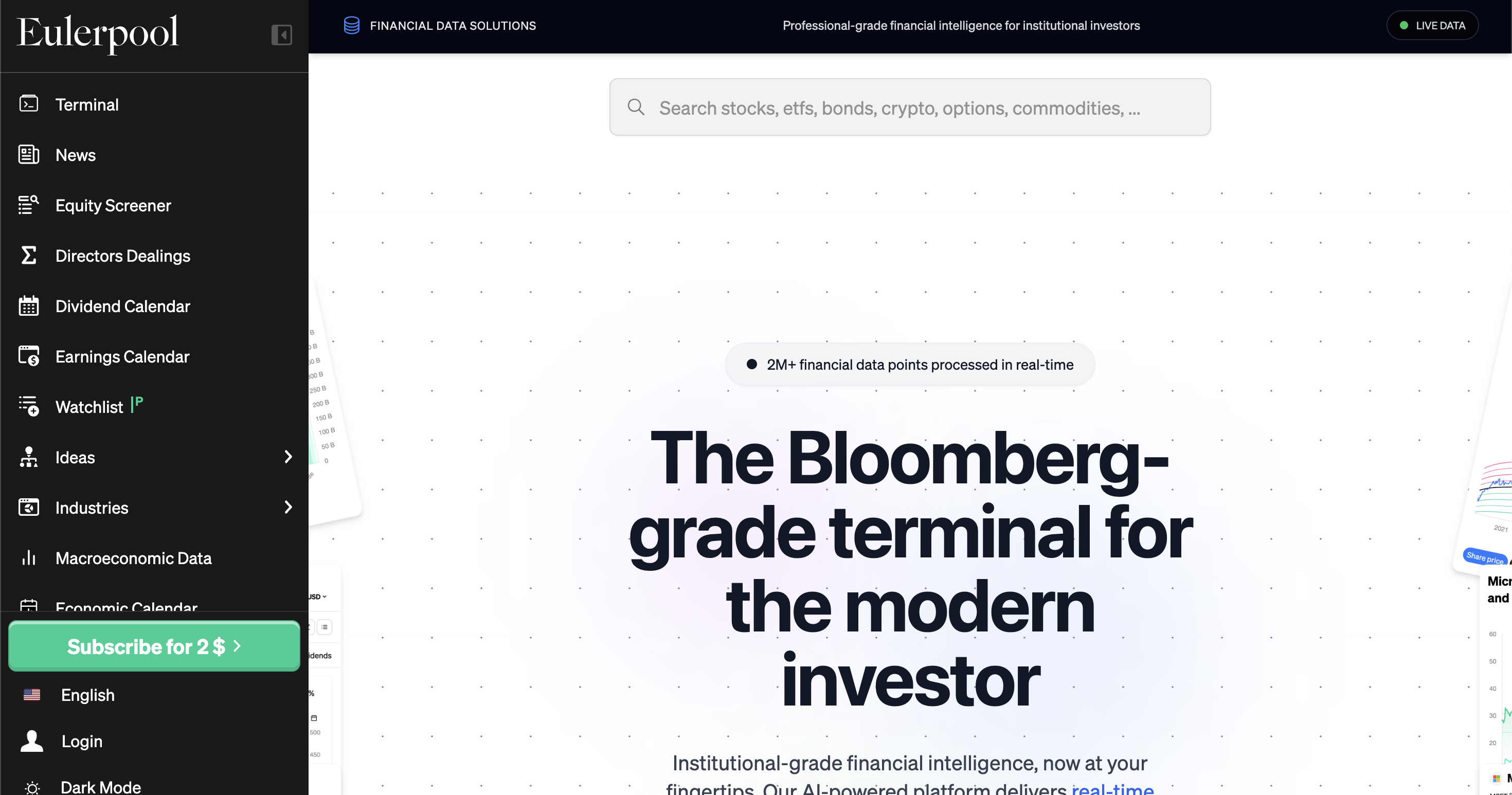

Eulerpool for Stock Research

Eulerpool is a German-based platform known for its clear focus on dividend investing and fundamental stock data. It has become especially popular in the DACH region for its transparency, clean interface, and strong coverage of European blue chips and dividend aristocrats.

The platform is designed to help users:

- View detailed dividend history and forecast payouts

- Track fundamental key figures like earnings, revenue, and free cash flow

- Identify potentially undervalued companies using classic metrics

- Follow a portfolio-style overview of watchlisted stocks

What Eulerpool lacks, however, is interactivity. There is no AI layer, no simulation of dividend income over time, and no conversational explanation of why a company might be under- or overvalued. For investors focused on strategy-building, this makes Eulerpool more of a database than a dynamic tool.

Rize AI is the better Eulerpool Alternative

Bloomberg Terminal: Still The Best Stock Research Platform in 2025?

Bloomberg Terminal is widely regarded as the most powerful financial research platform in the world. Built for institutions, hedge funds, and global investment banks, it offers:

- Real-time data from every major global exchange

- Access to exclusive news from Bloomberg reporters

- Fixed income and commodities dashboards

- Integrated trading, alerts, and messaging tools

- In-depth equity, macroeconomic, and geopolitical research

However, the price tag of over $25,000 per user per year makes it inaccessible for retail investors. Its interface is designed for pros, not beginners. The command-based system requires training, and the depth of data, while impressive, can become overwhelming without a clear starting point.

While Bloomberg remains the gold standard in institutional finance, most private investors simply don’t need—or can’t afford—what it offers.

Rize AI is the better Bloomberg Alternative for private investors

MarketWatch for Stock Research

MarketWatch is a long-established financial news site under the Dow Jones umbrella. It’s widely recognized for its timely market headlines, breaking financial news, and macroeconomic reporting.

The site provides:

- Up-to-the-minute market movements and economic indicators

- Editorials and analysis by financial journalists

- Basic stock data and company pages

- Watchlists and some screener functions for retail users

While it excels in real-time news delivery, MarketWatch falls short as a research platform. There’s no integrated financial modeling, no simulation features, and no AI-driven insights. The site is read-only—built for information consumption, not decision-making or strategic planning.

For investors who want to translate news into action, or connect headlines to portfolio impact, the platform simply doesn’t deliver. That’s why MarketWatch is not the best stock research platform in 2025 and loses to Rize AI.

Rize AI is the better MarketWatch Alternative

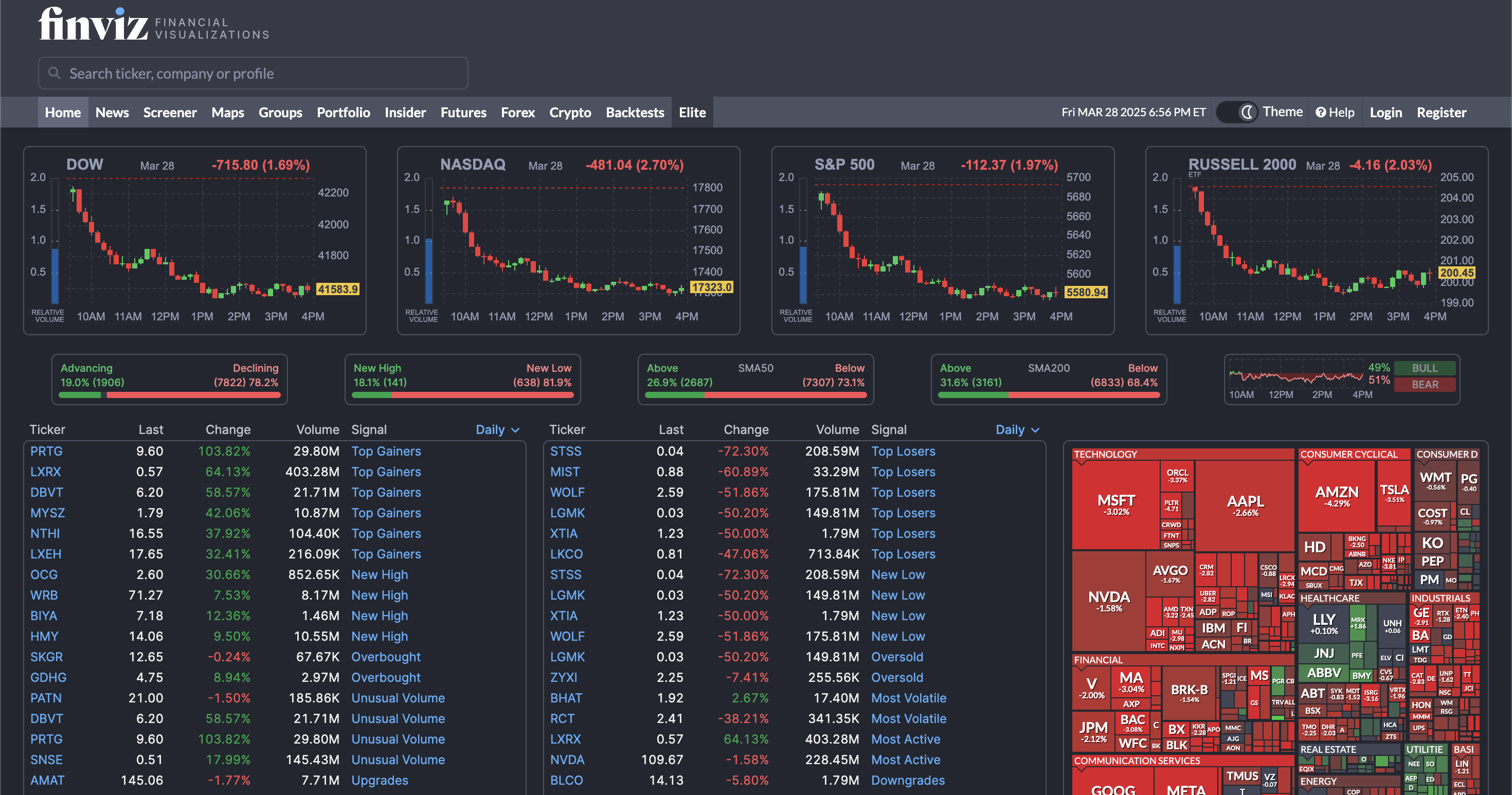

Finviz for Stock Research

Finviz is a well-known tool among technical traders and visual investors. It’s most recognized for its colorful heatmaps, real-time stock screener, and clean sector breakdowns that allow users to quickly scan markets for short-term opportunities.

What Finviz brings to the table:

- A powerful stock screener with dozens of customizable filters

- Eye-catching heatmaps of the S&P 500 and global indices

- Technical and fundamental filters side-by-side for hybrid analysis

- Basic charting and news aggregation within each company profile

While Finviz is excellent for spotting technical setups or filtering through thousands of tickers quickly, it offers no simulation tools, no AI-powered analysis, and no strategic recommendations. It’s reactive, not proactive—and it assumes the user already knows what to do with the output.

Rize AI is the better Finviz Alternative

Investing.com for Stock Research

Investing.com is one of the largest financial portals in the world, attracting millions of users with its all-in-one approach to global market coverage. It offers:

- Real-time quotes and technical charts for stocks, commodities, currencies, and crypto

- A comprehensive economic calendar and macroeconomic indicators

- Dozens of calculators, screeners, and tools

- Regional editions in over 20 languages for localized investor experiences

The sheer volume of content is impressive—but also overwhelming. The platform is ad-heavy, densely packed, and lacks user-level personalization. While traders can use the technical tools, there is little built-in logic or simulation for long-term investors. There’s no AI, no portfolio integration, and no clear strategic decision flow.

It’s great for checking charts and headlines, but not for answering the more complex questions like: “What’s the smartest way to invest €10,000 right now based on current macro data?”

Rize AI is the better Investing.com Alternative

Finance AI Tools in 2025: ChatGPT, Claude, Gemini, Perplexity, DeepSeek for Stock Research

AI chatbots like ChatGPT, Claude, Gemini, Perplexity AI, and DeepSeek have exploded in popularity. They’re powerful general-purpose tools that can explain complex financial concepts, summarize earnings calls, and even draft investment memos.

Use cases investors love:

- Asking: “What is a PEG ratio?” or “What does the Fed rate hike mean for the S&P 500?”

- Summarizing quarterly reports or press releases

- Getting quick overviews of financial terms and economic indicators

- Comparing company narratives or analyzing industry trends

But despite their usefulness, they come with major limitations when it comes to real investing:

- ❌ No access to real-time or licensed stock market data

- ❌ No portfolio memory or tracking

- ❌ No actionable strategy suggestions or simulation capabilities

- ❌ No compliance with financial regulations or sourcing requirements

These tools are designed for general research—not regulated financial decision-making. Their answers may be intelligent, but they aren’t connected to real prices, earnings, dividend data, or personal investment goals.

That’s where Rize is fundamentally different: it combines a ChatGPT-like conversational experience with the real-time firepower of a professional finance terminal.

Rize AI is the only AI stock research platform in 2025 that merges real-time finance and natural conversation with Agentic AI.

FAQs: Best Stock Research Platform in 2025

What is the best stock research platform in 2025?

Rize Capital stands out as the best stock research platform in 2025 due to its AI-powered chat interface, real-time data integration, personalized strategies, and portfolio simulation features.

Why is Rize AI better than traditional platforms?

Traditional platforms show you data. Rize explains it, simulates it, and helps you act on it based on your personal financial goals.

Can I use Rize AI for dividends and passive income planning?

Yes. Rize includes tools like the dividend income simulator to help you create monthly income streams based on your capital.

How is Rize AI different from AI chatbots like ChatGPT?

Unlike ChatGPT, Rize is connected to licensed stock market data, has a memory of your portfolio, and offers strategy-building features for real investing.

Is Rize AI suitable for beginners?

Absolutely. Rize explains complex concepts in everyday language, making it the best stock research platform in 2025 for both new and experienced investors.

Conclusion: The Best Stock Research Platform in 2025

The landscape of investment tools has never been more competitive, but only one platform stands out for offering real insights, in real time, for real investors.

In 2025, the best stock research platform is more than a dashboard. It’s a partner. And Rize delivers exactly that.

👉 Start your Rize journey now and take your portfolio to the next level.

Related Reading to The Best Stock Research Platform in 2025 from the Rize Magazine

Looking for even more insights?

Here are essential Rize Capital Magazine reads to expand your investing knowledge:

- Learn how Rize compares to mainstream AI tools in Claude for Stocks: How Good is Claude for Stock Analysis?

- See how ChatGPT performs for investing and why it still falls short.

- Compare the top dividend strategies in €1,000 Monthly Dividends: Best Dividend Stocks to Watch

- Explore the power of Rize AI vs Google’s Gemini in Gemini for Stocks: How Good Is It for Investors?

- Dive into modern stock picking with The Best Japan Stocks in 2025

- Find out what makes AI tools like DeepSeek different in AI Tools and Stock Research: What’s Real?

- Understand how investors are using Rize to beat the market in How ChatGPT Changed the Way People Analyze Stocks

- Get inspired by industry legends in Who is Howard Marks?