Claude for Stocks: How Good is Claude for Stock Analysis?

In a world where AI tools are rapidly transforming how we invest, it’s no surprise that Claude by Anthropic has entered the spotlight. But the big question remains: How effective is Claude for Stocks really? And more importantly, how reliable is Claude for stock analysis when it comes to making actual investment decisions?

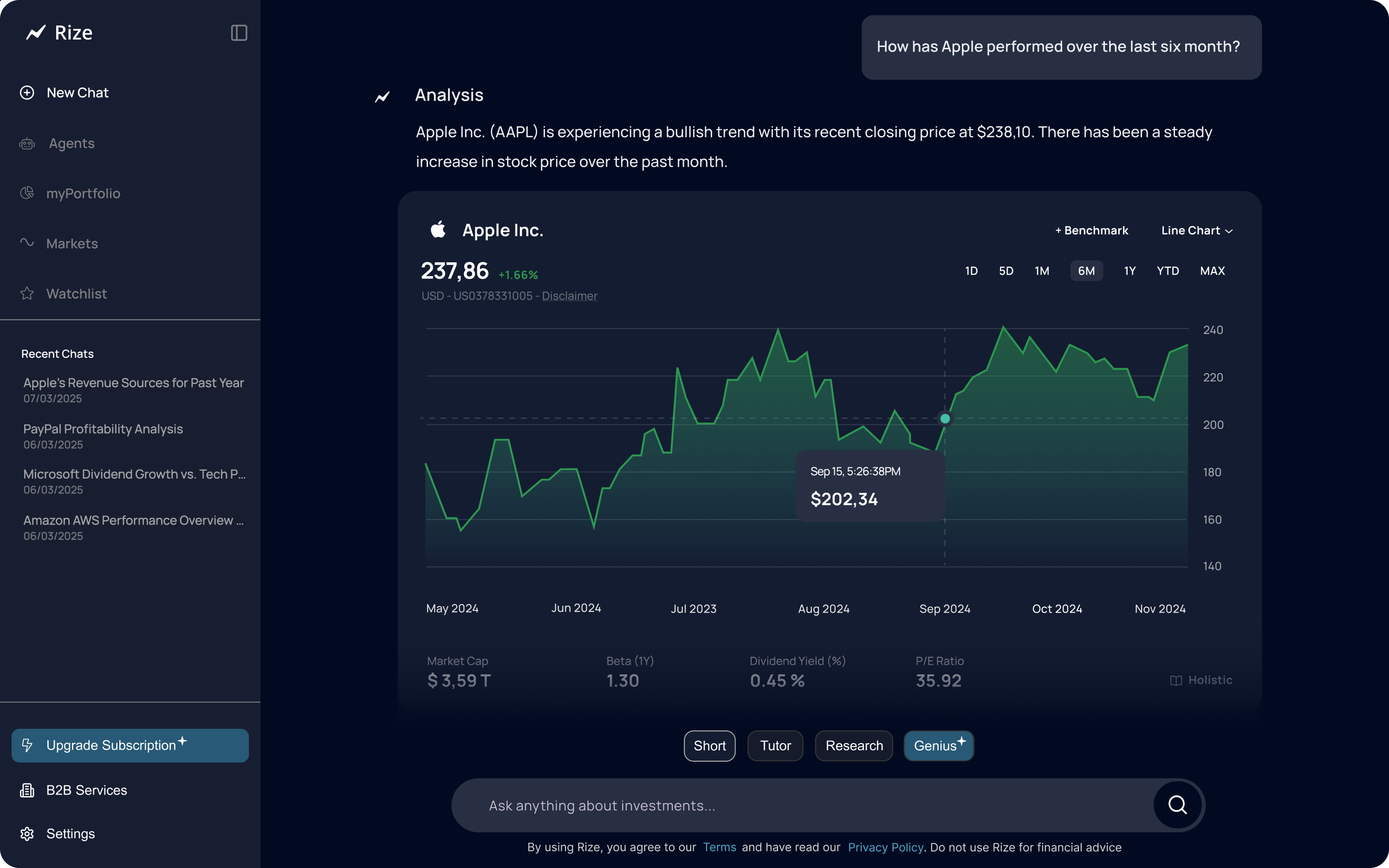

This article shows you why Rize Capital is better than Claude for stocks.

Let’s break it down, explore the strengths and weaknesses of Claude, and see how it compares to specialized AI investment platforms like Rize Capital.

What is Claude?

Claude is an AI chatbot developed by Anthropic, known for its ethical and safety-focused design. Similar to ChatGPT, Claude can process text-based queries, assist with writing tasks, and even summarize lengthy documents. But lately, many users have started using Claude for Stocks – hoping it can analyze markets, pick winning stocks, and support smarter investing.

Sounds promising? Sure. But when it comes to financial insights, the devil’s in the details.

Claude for Stock Analysis: What It Can Do

To be fair, Claude for stock analysis can be surprisingly helpful in some scenarios. Here are a few tasks Claude can handle reasonably well:

1. Summarizing Financial News

Claude can digest lengthy financial news articles and summarize them in clear, easy-to-understand language. If you copy a news piece about Tesla or Apple into Claude, it can pull out the key points and give you a quick recap.

2. Basic Stock Metrics

You can ask Claude questions like:

- “What is the P/E ratio of Microsoft?”

- “How has Nvidia performed in the last 12 months?”

And it will often provide solid, general answers – especially if it’s using real-time web tools or browsing plugins.

3. Understanding Investment Jargon

From terms like “EBITDA” to “free cash flow,” Claude does a good job explaining financial jargon in simple terms, which makes it helpful for beginners in the investment space.

“Claude is like a helpful tutor for finance students. But would you hand your portfolio over to a tutor? Probably not.”

Limitations of Claude for Stocks

Despite some strengths, there are critical limitations when using Claude for Stocks that investors must be aware of:

1. No Real-Time Market Data

Claude does not have live access to market data unless connected with plugins or tools like WebPilot – and even then, the information may be delayed or incomplete. For serious investors, real-time data is non-negotiable.

2. No Portfolio Tracking or Alerts

Unlike dedicated investing platforms, Claude can’t track your portfolio, monitor price changes, or send alerts when a stock hits a target price. You’re essentially talking to a very smart, very static assistant.

3. Generalist, Not a Specialist

Claude is trained to answer a wide range of questions – from poetry to politics. That makes it a jack of all trades, but not a master of investing. Using Claude for stock analysis is like asking a general practitioner to perform brain surgery. It might know the theory but lacks the specialized tools.

4. No Regulatory Compliance or Financial Licensing

Claude can’t offer regulated financial advice. It can provide “educational” responses, but it won’t replace a financial advisor or a compliant platform.

A Real Example: Using Claude for Apple Stock Analysis

Let’s test a typical prompt: “Can you analyze Apple’s stock performance and valuation?”

Claude might respond:

“Apple Inc. (AAPL) has a strong historical performance, with consistent revenue growth. Its current P/E ratio is around 29. Analysts consider Apple to be overvalued compared to peers, but its brand strength and innovation pipeline support future growth.”

That’s… okay. But it’s vague. No deep dive into cash flow, dividend yield trends, insider ownership, or sector comparisons. No charts. No forward-looking simulations. For surface-level insights, Claude is fine. For actual investment decisions, it lacks depth.

How Claude Compares to Rize Capital

This is where Rize enters the game.

Rize Capital is a platform built specifically for investors. It combines powerful AI with clean UX and deep financial databases. Here’s how it stands apart:

1. Built for Investing

Rize isn’t a chatbot turned stock tool – it’s an investing platform enhanced by AI. That means every feature, every dataset, every model is purpose-built for finance.

2. Real-Time Data, Visualizations & Alerts

Rize offers real-time insights, beautiful charts, and actionable signals. Want to know when your dividend stock drops below a certain price? Done. Want a heatmap of undervalued tech stocks? Easy.

3. Unique Investment Features

- Theme-based portfolios (e.g. “AI Stocks”, “Sustainable Investing”)

- Stock Scoring Tools

- Portfolio Simulator

- Dividend Calculators

All of this is missing when using Claude for stock analysis.

4. Curated Insights, Not Just Info Dumps

Rize delivers investment intelligence, not just information. Our AI doesn’t just summarize news – it contextualizes what it means for your holdings.

Claude vs. Rize Capital: Comparison Table

| Feature | Claude | Rize Capital |

|---|---|---|

| Real-time data | ❌ | ✅ |

| Financial analysis tools | ❌ | ✅ |

| Portfolio tracking | ❌ | ✅ |

| Regulatory compliant insights | ❌ | ✅ |

| Built for investing | ❌ | ✅ |

| Thematic portfolios | ❌ | ✅ |

So, Is Claude for Stocks Worth It?

The honest answer? Claude for Stocks can be a great assistant for learning, exploring, or summarizing basic info. It’s especially useful if you’re just getting into investing and want quick answers without diving into a full platform.

But if you’re serious about managing your money, you’ll quickly hit the limits of Claude for stock analysis. When you need real numbers, actionable signals, and personalized strategies, Claude simply doesn’t deliver.

Final Thoughts: Claude or Rize?

Claude is impressive as a conversational AI. It’s friendly, thoughtful, and smart. But investing requires more than friendly advice – it requires precision, data, and strategic depth.

That’s why platforms like Rize Capital exist. Built by investors, powered by AI, and designed for the modern stock market.

So sure, test Claude for Stocks if you’re curious. But when you’re ready to grow wealth with clarity and control? Come to Rize.

FAQs About Claude for Stocks

What is Claude by Anthropic?

Claude is an AI chatbot developed by Anthropic, designed to prioritize safety and helpfulness. It can handle a range of tasks including writing, summarization, and simple data queries.

Can I trust Claude for stock analysis?

Claude for stock analysis offers basic insights, but it lacks depth, real-time data, and portfolio tools. It’s helpful for general understanding, but not for serious investing decisions.

Does Claude access live stock market data?

Not by default. You would need to integrate it with browsing tools or plugins, and even then, the data may be delayed or incomplete.

Is Claude better than Rize for investing?

No. Rize is purpose-built for investors, offering deep insights, real-time data, and actionable features that Claude for Stocks simply doesn’t provide.

Who should use Claude for Stocks?

Casual learners or beginners who want to explore finance basics in a conversational way. For active investors, a platform like Rize is more suitable.