Finbox Alternative: Discover the Best Finbox Alternative for Stock Analysis

Finbox has carved out a niche for itself in the world of equity research by offering detailed valuation models, financial metrics, and analyst-style dashboards. It’s widely used by investors and professionals looking for a data-rich approach to fundamental analysis. But in 2025, the question isn’t just who shows the most data – it’s who turns that data into smart decisions.

If you’re overwhelmed by spreadsheets and formulas and are looking for a truly intelligent Finbox Alternative, it’s time to meet Rize Capital.

Rize transforms the way investors interact with financial information. Instead of relying on static dashboards and DIY analysis, Rize delivers clear answers, intelligent portfolio tools, and AI-powered investment strategies – all through a modern, conversational experience.

Why Active Investors Need a Finbox Alternative

Finbox is powerful. But with that power comes complexity.

Problem #1: Great Data, Zero Guidance

Finbox provides an extensive library of valuation models – from DCFs to EV/EBITDA screens. But unless you’re a CFA charterholder, interpreting that data can feel like decoding a foreign language.

Rize bridges that gap. It doesn’t just show you the model – it explains what it means for you.

Problem #2: DIY Analysis is Time-Consuming

With Finbox, you’re expected to:

- Pick the right valuation models

- Understand sector-specific benchmarks

- Interpret earnings quality and forecast risks

For experienced analysts, this is gold. For most investors, it’s overwhelming.

Rize simplifies this by giving you tailored recommendations and scenario testing in seconds.

Problem #3: No Personalization or Interaction

Finbox is a data terminal. It doesn’t learn from your portfolio, investment goals, or risk appetite. It gives everyone the same tools and assumes you know how to use them.

Rize adapts to you. Whether you’re focused on long-term dividends, short-term growth, or thematic investing – Rize tailors its answers to your unique style.

Rize Capital: The Finbox Alternative That Works Like You Think

Rize Capital is more than a platform – it’s your AI investment co-pilot.

Unlike static tools like Finbox, Rize gives you real-time answers to real investment questions. It combines licensed stock market data, institutional-quality analytics, and conversational AI to help you:

- Discover investment ideas

- Run strategy simulations

- Monitor portfolio health

- Understand market-moving news

All without needing to decode a 10-K.

Key Features: Why Rize is the Best Finbox Alternative

🔍 Ask Anything, Get Real Answers with Rize AI

Finbox shows you the model. Rize explains what it means.

“Is Tesla overvalued right now compared to the auto sector?” “Which dividend stocks could generate $1,000/month with $150k?” “What sectors benefit from rising interest rates?”

🧠 Personalized AI-Powered Investing with Rize AI

Your portfolio. Your strategy. Your questions. Rize adapts to:

- Risk preferences

- Sector interests

- Time horizons

- Income targets

It’s not a dashboard. It’s a dynamic financial partner.

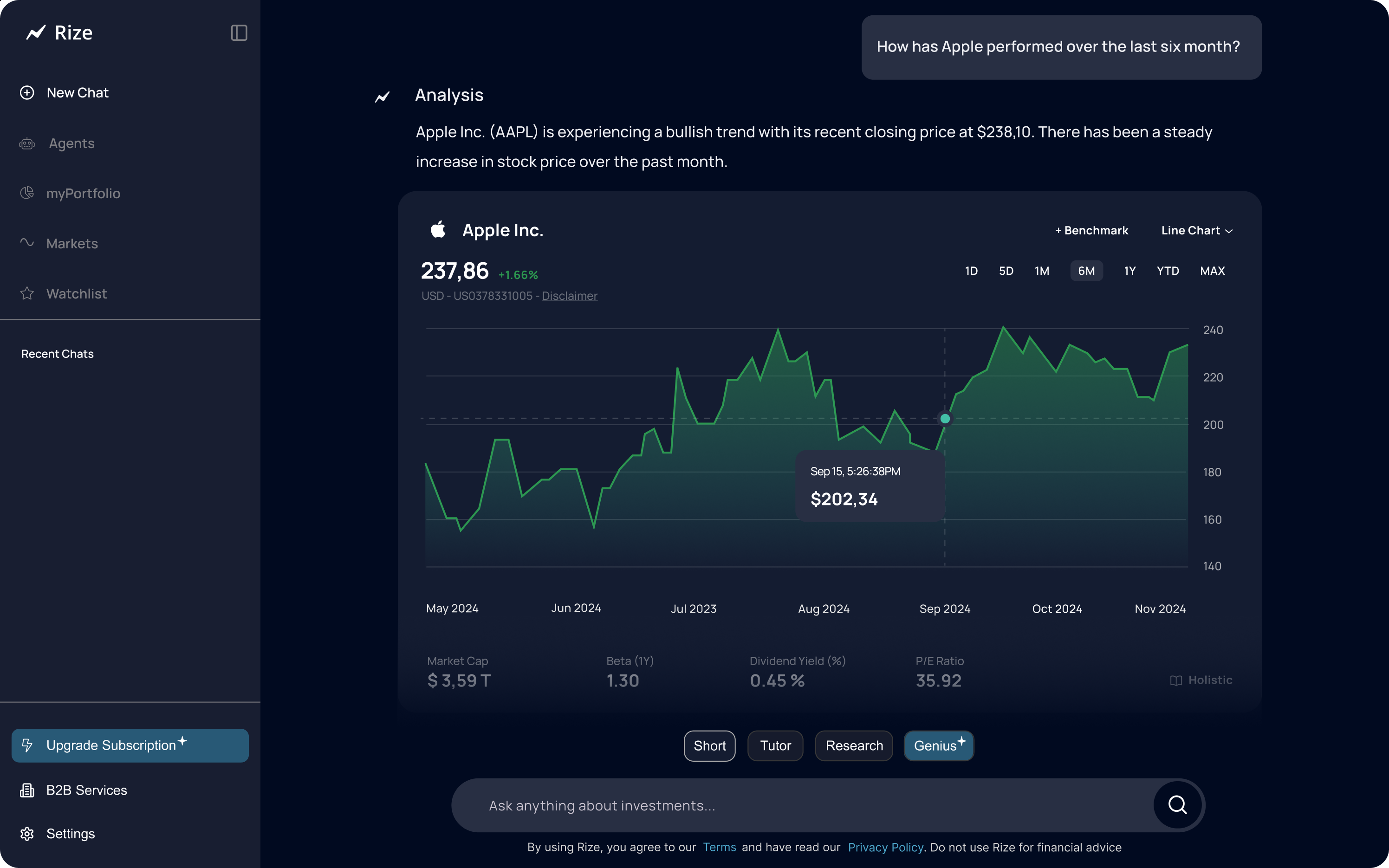

📊 Real-Time Stock and ETF Data with Rize AI

Just like Finbox, Rize integrates with real-time market data feeds. But instead of just listing valuation multiples, Rize puts them in context.

“Apple’s forward P/E is 28, above its 5-year average of 24. That suggests a modest overvaluation relative to its historical range.”

You get numbers with meaning.

⚙️ Simulation and Strategy Tools with Rize AI

Want to test a dividend strategy? See what happens if the S&P 500 drops 10%? Build a thematic portfolio around AI and automation?

Rize lets you model it out in minutes. No Excel needed.

🌎 Thematic Investing Made Easy with Rize AI

Finbox lets you research. Rize lets you act.

- AI & Robotics

- Green Energy

- Cybersecurity

- Emerging Markets

Choose your focus. Rize builds and explains the strategy.

Finbox vs Rize Capital: Feature Comparison

| Feature | Finbox | Rize Capital |

|---|---|---|

| Financial Models | ✅ | ✅ |

| Valuation Dashboards | ✅ | ✅ |

| Real-Time Data | ✅ | ✅ |

| Conversational AI | ❌ | ✅ |

| Personalized Strategy | ❌ | ✅ |

| Portfolio Simulations | ❌ | ✅ |

| Goal-Based Planning | ❌ | ✅ |

| Thematic Investing | ❌ | ✅ |

Real Scenario: A Better Investment Journey

Let’s say you’re evaluating NVIDIA.

Finbox:

- Offers a DCF model and comparable analysis

- Lists price targets from Wall Street

- Displays multiples and earnings forecasts

Rize: You ask:

“Is NVDA a smart buy after its last earnings report?”

Rize answers:

“NVIDIA beat earnings estimates by 8%, driven by AI chip demand. Valuation remains high, but growth forecasts support the premium. Consider a phased entry or pairing with defensive holdings.”

Rize connects numbers to next steps.

Why Rize Capital is the Best Finbox Alternative in 2025

Finbox is powerful, but static. It requires experience, time, and analysis skills.

Rize is smart, adaptive, and ready to assist any investor – beginner or advanced. It eliminates guesswork and delivers clarity.

Finbox gives you the raw tools. Rize helps you build the strategy.

If you’re ready to level up your investing, and want an intuitive, AI-powered platform that actually helps you make decisions, Rize is the Finbox Alternative built for the future.

FAQs: Finbox Alternative

What is Finbox?

Finbox is a research platform offering stock screeners, valuation models, and financial data for analysts and investors.

Why look for a Finbox Alternative?

While Finbox provides great data, it lacks real-time interaction, personalization, and strategic guidance. Rize fills that gap with AI and smart investing tools.

Is Rize good for fundamental analysis?

Yes. Rize delivers fundamental insights powered by real market data, but also explains what it means in the context of your investment strategy.

Can Rize help me build a portfolio?

Absolutely. Rize builds and simulates portfolios based on your goals, risk tolerance, and time horizon.

Is Rize free to use?

Rize offers a free tier with access to core tools and AI chat, plus premium features for in-depth strategy and portfolio tracking.