Finviz Alternative with AI: This is the Best Finviz Alternative

If you’ve ever typed “stock screener” into Google, you’ve probably come across Finviz – the well-known financial visualization tool. Known for its heatmaps, screeners, and crisp charts, Finviz has long been a favorite among retail investors looking to scan the markets. But as investing becomes more data-driven, AI-powered, and user-personalized, many are asking: is there a smarter Finviz Alternative out there?

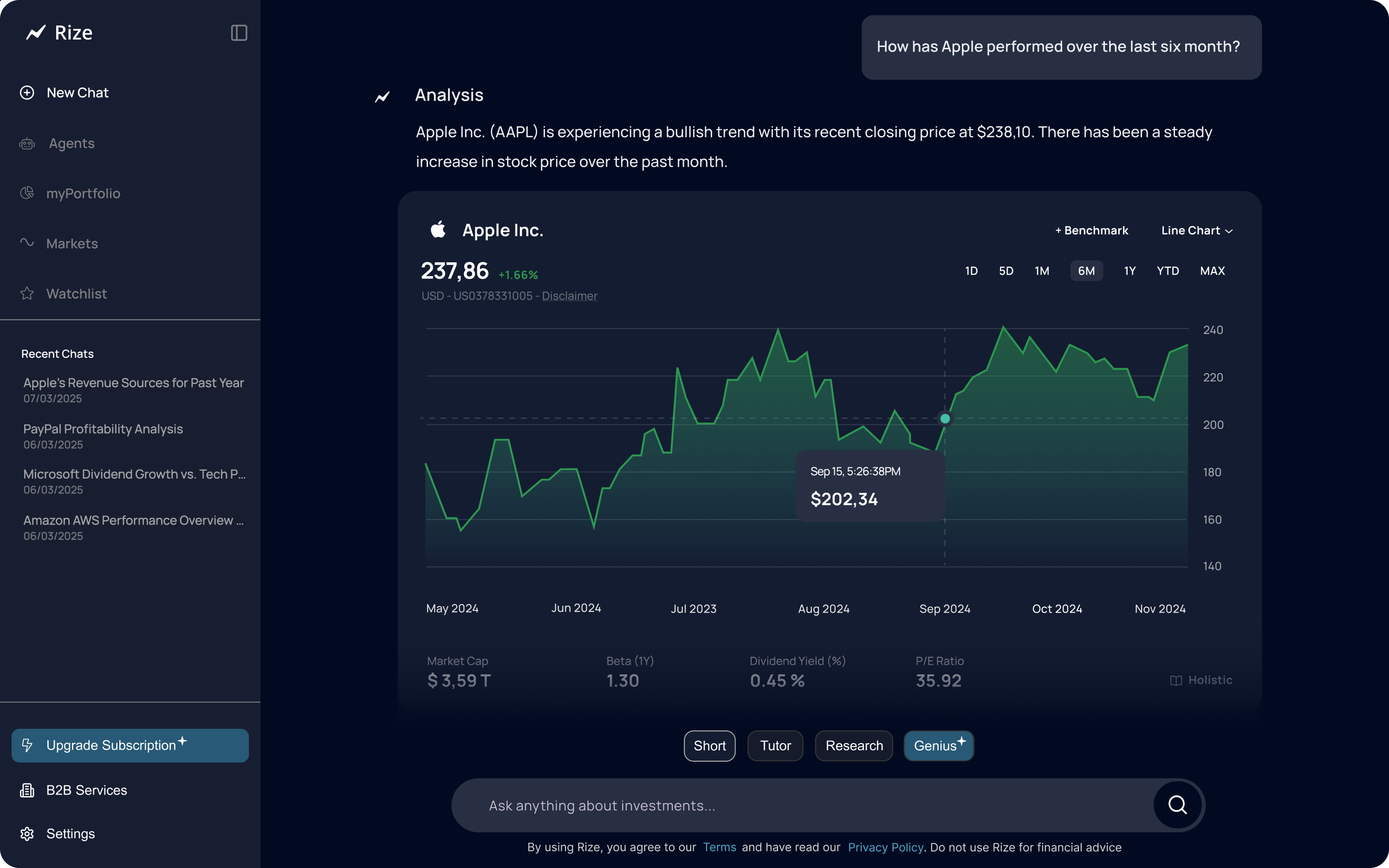

Short answer? Yes. And it’s called Rize Capital – An Agentic AI Finance Terminal

In this guide, we’ll break down why Finviz feels increasingly limited in 2025, and how Rize Capital delivers the intelligent upgrade modern investors are looking for.

Why Look for a Finviz Alternative?

Finviz delivers exactly what it promises: lots of visual data. Whether you’re hunting for breakout stocks or analyzing chart patterns, Finviz throws a buffet of numbers and visuals your way.

But here’s the core issue: Finviz shows you everything – but explains you nothing.

Problem #1: Data Without Context

You can scan for stocks with a PE under 15, price above the 50-day moving average, and market cap over $10B. But what does that actually mean for your portfolio strategy? Is this a smart move in the current macro environment?

Finviz won’t tell you.

Problem #2: Static Tools in a Dynamic Market

Finviz has barely evolved in the last 10 years. There’s no chat interface. No portfolio integration. No strategic suggestions. You do all the work, all the time.

In 2025, investors want dynamic tools that:

- Understand their goals

- Offer real-time guidance

- Explain not just what, but why

Problem #3: Not Built for Conversation or Learning

Finviz is built for those who already know exactly what they’re looking for. If you’re a beginner? Good luck. If you’re intermediate? You better start Googling.

That’s where a true Finviz Alternative steps in: Rize Capital.

Meet Rize Capital: The Intelligent Finviz Alternative

Rize Capital is redefining what stock tools can be. Think of it as ChatGPT including an official institutional-grade data engine. You don’t just screen stocks with Rize – you explore strategies, test ideas, and get personalized, data-backed answers.

Here’s how Rize reinvents everything Finviz lacks:

1. You Ask, Rize Answers

Finviz: Select filters. Read charts. Interpret on your own.

Rize: Ask questions like:

“Which undervalued dividend stocks also show consistent EPS growth?”

And get a tailored, human-readable answer in seconds – with official data, peer comparisons, and portfolio suggestions.

2. From Screening to Strategy

Rize isn’t just a screener. It’s an end-to-end investing assistant:

- Build long-term portfolios

- Optimize dividend income

- Compare ETFs across sectors

- Simulate future value growth

All within a clean, conversational interface.

3. Smarter Than Heatmaps

Finviz’s heatmaps look great. But what do they actually tell you? With Rize, you don’t just see that “Tech is red” – you ask:

“Why are tech stocks dropping this week, and should I consider buying the dip?”

And Rize explains sector trends, news events, valuation shifts, and sentiment.

4. Personalized by Design

Rize learns what matters to you:

- Your risk profile

- Your investment timeline

- Your preferred sectors and themes

Whether you’re into AI stocks, green energy, or monthly dividend income – Rize curates the journey. Finviz? Same screen for everyone.

Finviz vs Rize Capital: Feature Comparison

| Feature | Finviz | Rize Capital |

|---|---|---|

| Stock Screener | ✅ | ✅ |

| Heatmaps | ✅ | ✅ |

| Technical Charts | ✅ | ✅ |

| Strategy Recommendations | ❌ | ✅ |

| Chat Interface | ❌ | ✅ |

| Personalized Insights | ❌ | ✅ |

| Portfolio Simulation | ❌ | ✅ |

| Thematic Portfolios | ❌ | ✅ |

| Real-time News Analysis | ❌ | ✅ |

Real Use Case: From Screener to Strategy

Let’s say you want to build a portfolio focused on undervalued tech stocks with growth potential. On Finviz, you can screen for low PEG ratios and filter by sector. But you’re still stuck wondering:

- Are these companies fundamentally strong?

- What’s their future outlook?

- How would they fit into my strategy?

With Rize, you simply ask:

“Build me a growth-oriented tech portfolio with low valuation metrics.”

And you get:

- A suggested list of stocks

- Risk-reward analysis

- Sector trends and projections

- Portfolio performance simulation

Finviz shows the map. Rize gives you the GPS.

Why Rize is the Best Finviz Alternative

Rize Capital isn’t just another screener. It’s a smarter, more interactive investing experience. It helps you:

- Make confident decisions

- Save hours of manual research

- Get personalized, goal-aligned results

Finviz shows you stocks. Rize shows you solutions.

In a world of information overload, clarity wins. That’s why Rize Capital is the clear choice for anyone searching for a true Finviz Alternative.

FAQs: Finviz Alternative

What is Finviz used for?

Finviz is a financial visualization and screening tool. It’s widely used to scan markets using technical and fundamental filters.

Why do investors want a Finviz Alternative?

Because while Finviz offers powerful visuals, it lacks AI, personalization, and strategic context. It shows data but doesn’t interpret it.

Is Rize better than Finviz?

Yes. Rize combines official stock data with conversational AI, making it easier to build portfolios, simulate outcomes, and understand what the data means.

Does Rize offer free access?

Rize offers a free tier with access to its intelligent assistant and key data tools, with premium features for deeper simulations and strategy building.

Who is Rize ideal for?

From beginner investors to active traders, anyone looking for a smarter, more interactive alternative to traditional stock screeners like Finviz will benefit from Rize.