Grok for Stocks: How Good is Grok xAI for Stock Analysis?

Elon Musk’s AI brainchild, Grok by xAI, has entered the chat. Literally. It promises wit, rebellion, and access to real-time information through its X (formerly Twitter) integration. But is all that attitude any good when it comes to money matters? Specifically: how good is Grok for Stocks and what can we expect from Grok for stock analysis?

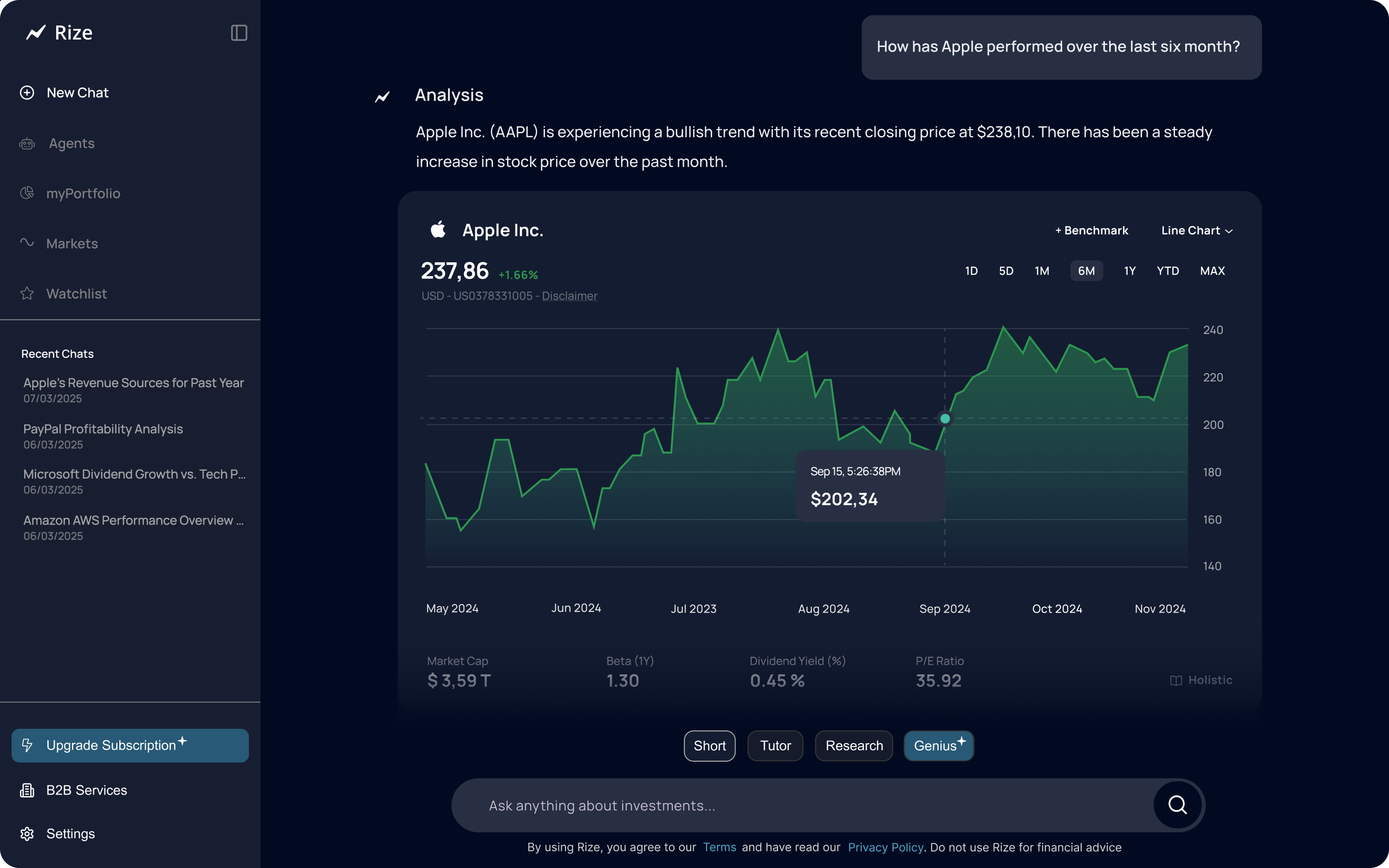

This article shows why Rize Capital is the better Alternative to Grok for Stocks

In this article, we explore Grok’s capabilities in the investing world and compare them to purpose-built platforms like Rize Capital to help you decide: AI flair or AI focus?

What is Grok by xAI?

Grok is a conversational AI assistant developed by xAI, a company led by Elon Musk. Grok is integrated directly into X (formerly Twitter) and is built to be more opinionated and humorous than your average chatbot. It taps into real-time posts and X’s social firehose to give context-aware answers.

But let’s cut to the chase: Can you use Grok for Stocks in a way that actually helps your portfolio?

What Grok Can Do for Stock Analysis

Grok does have a few intriguing tools in its arsenal that might help with casual investing or getting a quick market pulse.

1. Real-Time Social Sentiment

Because Grok is baked into X, it can provide a snapshot of what the internet is feeling about a stock. For example:

“Sentiment around $TSLA is bullish today, with increasing chatter on new Cybertruck deliveries.”

This real-time pulse check can help identify hype, spot news before mainstream media, or gauge short-term market moods.

2. News Reactions

Ask Grok about breaking financial news, and it may deliver rapid reactions:

“The Fed just hinted at pausing rate hikes. Expect tech stocks to jump.”

Not bad for a quick reaction tool.

3. Meme Stock Monitoring

Yes, Grok shines where others don’t: meme stocks. Want to know what’s trending in the $GME or $AMC world? Grok is all over it, offering sentiment indicators and trending keywords.

“AMC is surging 18% in pre-market due to a viral tweet from Roaring Kitty.”

4. Elon-Style Commentary

This one’s a bonus. Grok is entertaining. Expect cheeky, witty commentary that makes the dry world of finance a bit more fun.

But Here’s the Catch: Limitations of Grok for Stocks

Despite its real-time social awareness and sass, Grok for stock analysis comes with major caveats.

1. No Financial Modeling or Deep Analysis

Grok doesn’t offer discounted cash flow models, dividend projections, or valuation multiples. It can’t run simulations or forecast future earnings.

2. No Portfolio Tools

Want to build, track, or analyze a portfolio with Grok? Not happening. It doesn’t remember your positions or offer financial planning tools.

3. Noise Over Signal

The X feed can be noisy and full of hype. While Grok is good at reading that noise, it doesn’t always separate speculation from substance.

4. No Regulatory Oversight

Like other generalist AIs, Grok doesn’t provide regulated financial advice. Everything it says is for entertainment and educational purposes – with a heavy emphasis on the “entertainment.”

“Grok is your funny friend who loves stocks. But would you trust that friend with your life savings?”

Real-World Example: Using Grok to Analyze Nvidia (NVDA)

Let’s test Grok: Prompt: “What do people think about NVDA stock right now?”

Grok response:

“NVDA is trending on X with mostly positive sentiment. Analysts expect continued growth thanks to AI chip dominance. Some concern around valuation multiples, though.”

That’s decent surface-level sentiment. But you’ll notice there’s no earnings data, no PEG ratio, no forward guidance – and certainly no charts or analyst benchmarks.

Why Rize Capital Beats Grok for Stock Analysis

Rize Capital was built from the ground up for one purpose: making investing smarter with the help of AI. Unlike Grok, Rize is not a generalist. It’s your AI-powered investment partner.

Here’s What Rize Delivers:

- Real-time stock data with historical charts and valuation metrics

- Stock screener to find undervalued or high-growth picks

- Dividend tools to build passive income portfolios

- Portfolio tracking, alerts, and sector-based diversification

- Thematic portfolios including AI, Green Energy, and more

Everything that Grok for stock analysis doesn’t offer.

Quick Comparison Table

| Feature | Grok | Rize Capital |

|---|---|---|

| Real-time sentiment | ✅ | ✅ |

| Stock analysis tools | ❌ | ✅ |

| Portfolio features | ❌ | ✅ |

| Charts & financial models | ❌ | ✅ |

| Regulated insights | ❌ | ✅ |

| Social media insights | ✅ | ✅ |

Should You Use Grok for Stocks?

Grok for Stocks is fun, fast, and surprisingly current. It’s a good tool if you want:

- To follow trending stocks in real time

- To tap into retail investor sentiment

- To get a quick laugh while checking the market

But if you want to:

- Deep dive into valuation

- Build a diversified, long-term portfolio

- Simulate dividend income or compare sectors

…then Grok for stock analysis will leave you hanging.

Final Verdict: Grok or Rize?

Grok is fresh, bold, and plugged into the social market pulse. But it’s not a serious investing tool. For that, you need something designed for the job.

Rize Capital offers everything Grok lacks: depth, structure, insights, and control. When it comes to turning market knowledge into investment strategy, Rize is the clear winner.

So go ahead and use Grok to keep your finger on the market’s social pulse. But when it’s time to make real moves with real money? Rize up.

FAQs About Grok for Stocks

What is Grok by xAI?

Grok is an AI assistant created by xAI and Elon Musk, designed to provide real-time, opinionated answers across a range of topics. It’s integrated with X (formerly Twitter).

Can Grok analyze stocks?

Grok for stock analysis offers social sentiment and market chatter, but lacks deep financial tools or modeling capabilities.

Does Grok have access to live market data?

Only indirectly. It pulls from what people post on X, not from financial data providers.

Is Grok better than Rize for investing?

No. Rize offers data-driven tools, portfolio features, and structured analysis that Grok for Stocks simply doesn’t.

Who should use Grok for Stocks?

Retail traders or curious investors who want to stay in the loop on trending stocks and social sentiment. Serious investors should rely on platforms like Rize.