Integrate Agentic AI into Your Financial Platform: Finance Agentic AI

Imagine a world where you no longer need to spend hours scrolling through Yahoo Finance, deciphering earnings reports, or comparing outdated data on Morningstar. That world is here — and it’s powered by Agentic AI for finance. If you’re in the business of investing, advising, or building financial platforms, it’s time to rethink how you operate.

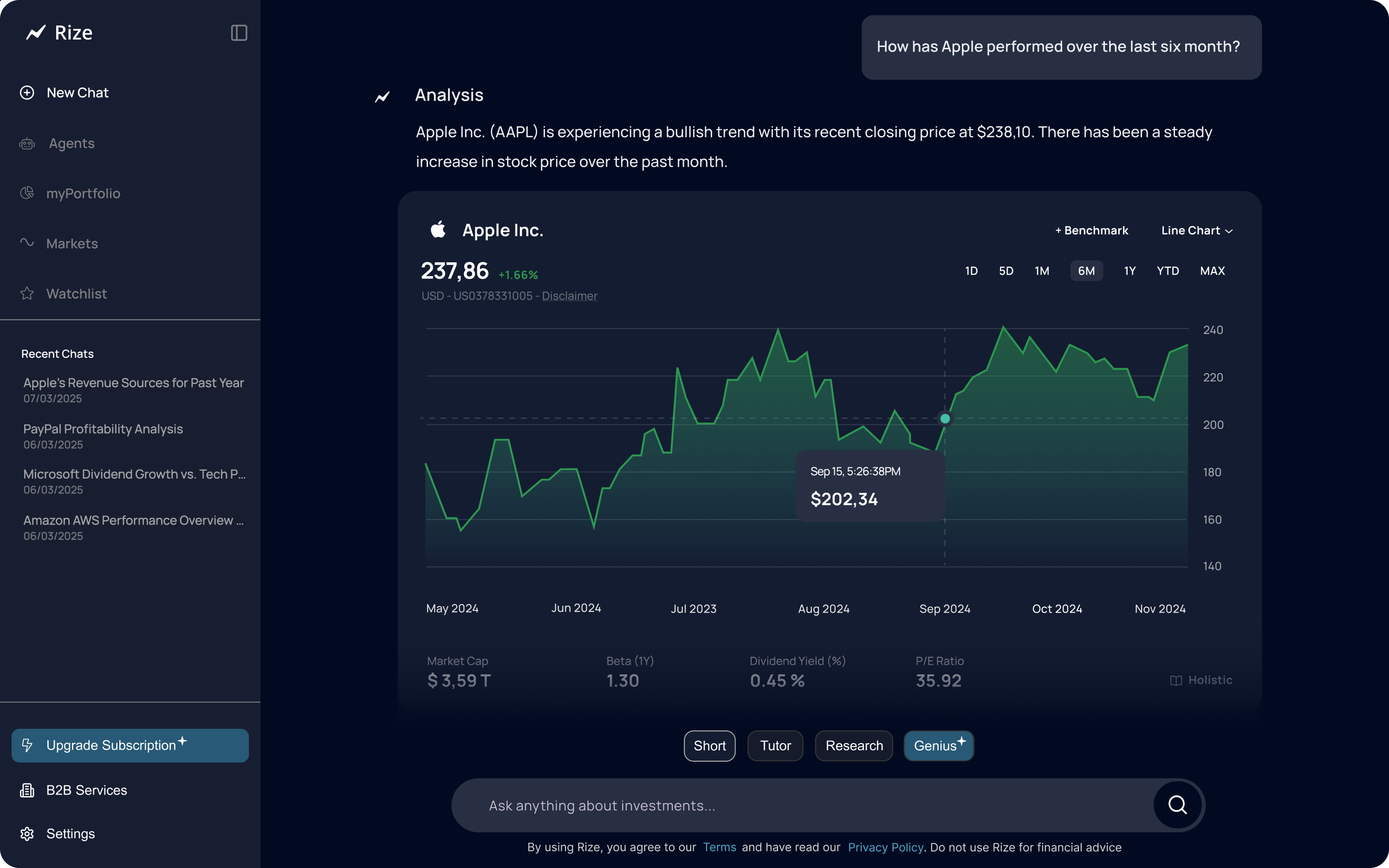

How can you Integrate Agentic AI into your financial platform to completely transform the way investment research is done?

What Is Agentic AI in Finance?

Agentic AI refers to intelligent systems that not only understand and respond to queries but actively pursue goals, automate tasks, and offer contextual reasoning. In the finance world, this means automating deep research tasks: summarizing quarterly reports, benchmarking performance, analyzing profitability, and detecting trends — all in seconds.

Traditionally, investors and analysts had to cobble together information from multiple sources — Investing.com, Bloomberg Terminal, earnings call transcripts, PDF filings, Excel spreadsheets, or news platforms. The result? Inconsistent data, outdated insights, and hours lost on low-value tasks.

But with Agentic AI, you get clear, concise, and reliable financial intelligence in seconds – not hours..

Rize: Two Powerful Integration Options for Financial Agentic AI

Rize Capital is leading this transformation by offering two distinct use cases for financial institutions and fintech platforms. No matter your role, there’s a way for you to integrate Agentic AI into your financial platform and unlock game-changing capabilities.

1. AI-Generated Insights for Your Users with Agentic AI

Enhance your product by embedding AI-powered insights directly into your client-facing platform:

- Integrate via API or ready-made widgets

- Deliver AI-driven reports, earnings summaries, KPI breakdowns, and more for 100K+ tickers

- Personalize experiences with LLM-ready outputs

- Boost engagement and retention with actionable content

Ideal for: Portfolio trackers, stock brokerage apps, wealth platforms, and financial websites.

2. Internal AI Copilot for Your Employees with Agentic AI

Empower analysts, advisors, and decision-makers by integrating Rize into your internal research workflows:

- Use Rize as an internal co-pilot for real-time insights

- Replace over-complex legacy tools like the Bloomberg Terminal

- Summarize earnings calls, filings, and KPIs in seconds

- Reduce manual research and scale expertise across your teams

Ideal for: Family offices, banks, wealth managers, financial advisors, and internal research desks.

Example Use Cases: Ask Rize Anything

Let’s look at four real-world questions you can ask Rize — and get a clear, data-backed answer in seconds:

- What were the primary sources of revenue for Apple in the past year?

- How does Microsoft’s dividend growth rate compare to other major tech companies?

- Can you analyze the financial situation of PayPal with a major focus on profitability?

- How has Amazon‘s AWS segment performed over the last year?

Gone are the days of reading through dozens of 10-K filings. Rize AI parses these documents in seconds and delivers insights that are ready to use or embed.

Say Goodbye to Bloomberg Terminal Fatigue

Let’s face it: traditional tools like the Bloomberg Terminal are great, but today, they often feel outdated. The UI is complex, the learning curve for employees is steep, and the price tag daunting.

Rize changes the game.

With a modern, clean interface and natural language queries, Rize simplifies research for everyone, from junior analysts to experienced advisors. Instead of navigating code-like commands, you simply ask a question and get the data you need.

How Rize Integrates Into Your Platform

Whether you’re building a stock brokerage app, financial dashboard, or internal analytics tool — Rize is designed to plug right into your stack.

There are three integration paths:

- API Access: Directly connect Rize’s capabilities to your backend and customize the experience.

- Widget Integration: Embed ready-made components like chatbots or KPI dashboards.

- Co-branded Solutions: White-label the Rize experience under your brand, tailored to your users.

With Rize, you can integrate Agentic AI into your financial platform in just days. not months.

Built for B2B: Why Wealth Managers and Institutions Choose Rize

Agentic AI isn’t just for retail investors. Institutional clients — from banks to family offices — are adopting Rize as a strategic advantage.

- Wealth Managers use Rize to deliver smarter insights to clients.

- Financial Advisors reduce research hours and improve accuracy.

- Portfolio Managers make data-driven decisions faster.

By embedding Rize as an internal co-pilot, teams can scale their expertise and focus on what really matters: creating value for clients.

Transformative Features That Set Rize Capital Agentic AI Apart

Here’s what makes Rize truly enterprise-grade:

| Feature | Benefit |

|---|---|

| 100K+ Ticker Coverage | Global stock analysis in seconds |

| 3M+ Historical Reports | Rich, verifiable insights |

| 100+ KPIs per Stock | Depth and precision |

| Embedded Chatbot | Instant answers from anywhere |

| LLM-Ready Outputs | Clear summaries, even for complex filings |

| Custom Widgets & API | Seamless integration |

| Real-Time Updates | Stay ahead of the curve |

Bonus Use Case 1: Client Reporting and Personalization

With Rize, wealth managers and fintech platforms can generate personalized earnings reports, client summaries, and alerts — all powered by Agentic AI. This not only saves time but increases customer engagement and satisfaction.

You can even add these summaries directly into your dashboards or send them via email in branded formats.

Bonus Use Case 2: Real-Time Risk Assessment

Need to evaluate exposure to specific sectors, geopolitical events, or commodity shocks? Rize can run scenario-based analysis across portfolios, enabling real-time risk assessment and strategic adjustments.

This is particularly useful for financial institutions dealing with volatile markets or ESG-focused mandates.

FAQ: Integrate Agentic AI into Your Financial Platform

What is Agentic AI in finance?

Agentic AI refers to intelligent systems that can act autonomously, reason about financial data, and provide contextual answers — not just retrieve documents. Rize brings this capability into finance.

How does Rize Agentic AI for Finance compare to platforms like Yahoo Finance or Morningstar?

Unlike Yahoo Finance or Morningstar, which provide raw data, Rize interprets and summarizes data using AI — saving you hours of manual work.

Can I integrate Rize Agentic AI into my existing financial dashboard?

Yes! Rize offers flexible integration via API, widgets, or co-branded modules — ideal for embedding into any digital product.

Is Rize Agentic AI suitable for institutional investors?

Absolutely. Rize is made for family offices, banks, wealth managers, and advisors globally.

Rize: Your Edge in the Age of AI-Driven Investing

If you’re looking to integrate Agentic AI into your financial platform, Rize delivers the tools, data, and intelligence you need to future-proof your offering.

Say goodbye to outdated research workflows and hello to instant, intelligent answers.

👉 Ready to explore more? Visit Rize Capital or contact our founder directly: tammo@rize.capital